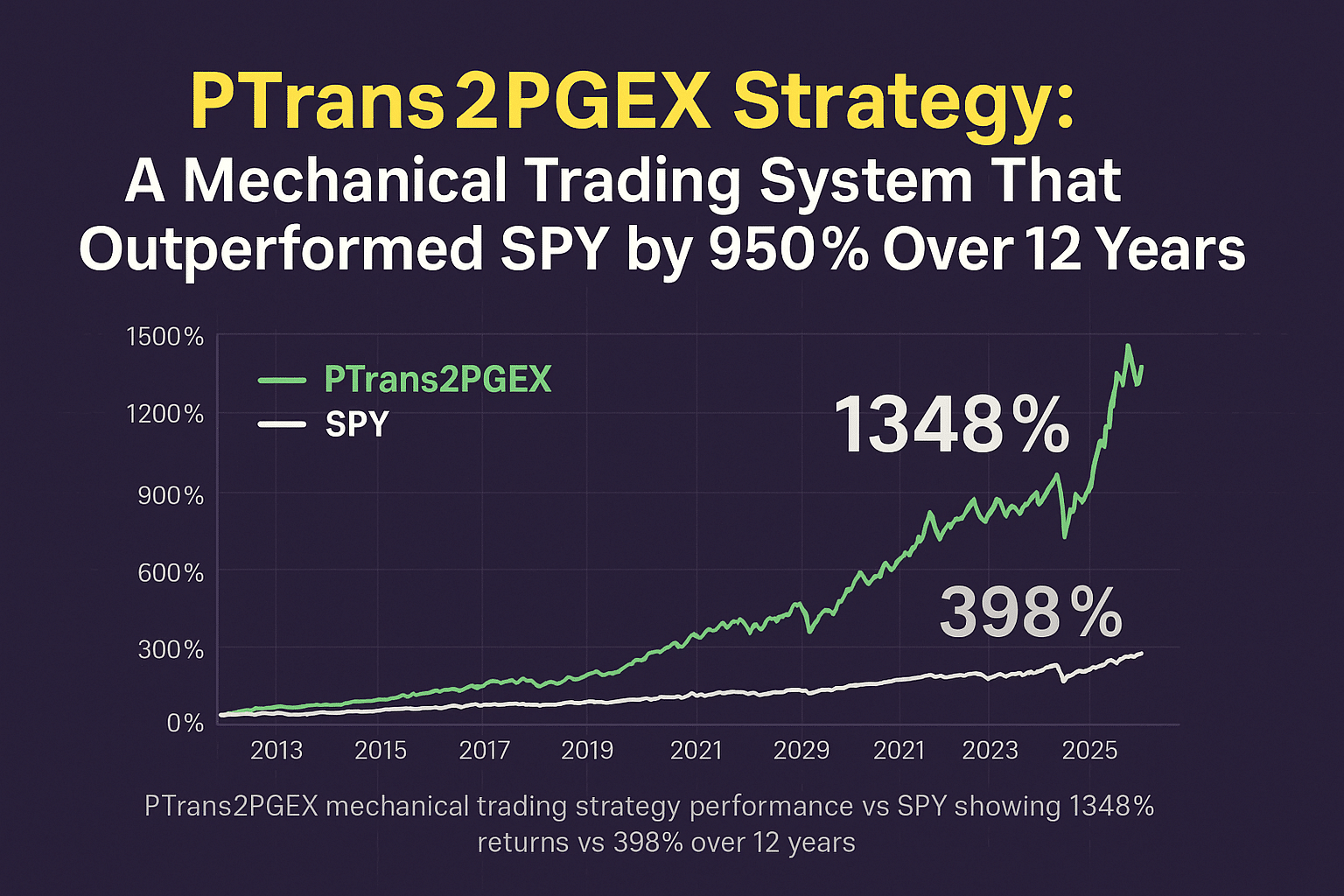

PTrans2PGEX Strategy: A Mechanical Trading Strategy That Outperformed SPY by 950% Over 12 Years

Have you ever executed what seemed like a perfect trade setup—clean technicals, solid fundamentals, everything aligned—only to watch it immediately move against you the moment you entered?

Or experienced the opposite frustration: identifying an excellent opportunity but hesitating to pull the trigger, then watching the stock rocket higher without you?

You’re not alone. Most active traders struggle with the same fundamental challenge: emotion-driven decisions that sabotage otherwise great analysis.

The psychological hurdles that destroy trading accounts include:

- Fear of being wrong leading to missed opportunities

- Greed to maximize every move causing overtrading

- Analysis paralysis from tracking too many variables

- Revenge trading after losses

These psychological factors often matter more than technical skills or market knowledge. But what if you could remove emotion from the equation entirely?

That’s exactly what we’re going to show you how to do today with our 100% mechanical trading strategy.

Table of Contents

Introducing PTrans2PGEX: A 100% Mechanical Trading Strategy

The PTrans2PGEX mechanical trading strategy eliminates emotional decision-making by using predetermined entry and exit rules based on options market structure. This systematic approach has generated remarkable long-term performance:

Proven 12+ Year Track Record (January 2013 – May 2025)

Over the last decade plus of various market conditions, the results of our 100% mechanical trading strategy speak for themselves:

- Total Returns: 1,348% vs SPY’s 398%

- Win Rate: 75.55% across 1,783 trades

- Maximum Drawdown: 29.21% vs SPY’s 33.57%

- Average Trade: $755.97 profit with positive expectancy

This isn’t about chasing hot stocks or timing perfect entries. It’s about understanding how options market structure creates predictable price movements and positioning yourself to benefit from those patterns consistently.

Understanding Options-Driven Market Structure

Why Options Drive Stock Prices

In today’s markets, options activity often drives stock price movement rather than the reverse. When traders buy call options above current prices, market makers must hedge by purchasing shares. As prices rise toward those strike prices, hedging pressure intensifies, creating a feedback loop that accelerates upward movement.

The PTrans2PGEX strategy identifies when this structural setup exists and positions traders to benefit from the resulting price acceleration.

The Two Key Levels Explained

PTrans2PGEX utilizes two critical levels derived from options market structure:

- PTrans (Positive Transition): The strike price where call speculators take control of the options structure

- PGEX (Positive Gamma Exposure): The strike with the highest concentration of call gamma exposure

The Mechanical Trading Strategy Rules (Beautifully Simple)

The beauty of this systematic trading approach lies in its simplicity:

Entry Rules

- Stock starts the session below PTrans

- Stock closes above PTrans

- Enter position at next market open

Exit Rules

- Stock closes above PGEX

- Exit position at next market open

Position Management

- Position Size: 4-7% of account equity per trade

- Stop Loss: None (backtesting shows stops hurt performance)

- Trade Universe: Large-cap liquid stocks from GammaEdge liquidity list

Why No Stop Loss?

Through extensive backtesting of our 100% mechanical trading strategy, we found that incorporating stop losses actually degraded performance. The options market structure provides natural exit points that are more effective than arbitrary price-based stops.

Comprehensive Performance Analysis

5-Year Performance (June 2020 – May 2025)

- PTrans2PGEX: 216% total returns

- SPY: 106% total returns

- Risk-Adjusted Returns: Better downside protection during corrections

Recent Performance Highlights (YTD May 2025)

- PTrans2PGEX: +11.1% with 10.97% maximum drawdown

- SPY: +0.6% with 18.58% maximum drawdown

- Win Rate: 83% (40 winners, 8 losers from 48 trades)

- Sharpe Ratio: 1.25 (excellent risk-adjusted performance)

While SPY investors endured an 18.6% drawdown just to earn 0.6% for the year, PTrans2PGEX captured 11.1% returns with nearly half the downside risk.

Here’s the SPY vs. P2P Backtested Results:

Why This 100% Mechanical Trading Strategy Works Across Market Cycles

The PTrans2PGEX strategy maintained its edge through dramatically different market environments:

- 2015 taper tantrum

- 2018 correction

- 2020 COVID crash

- 2022 bear market

- 2024-2025 AI-driven rallies

This consistency stems from the strategy’s foundation in market structure mechanics rather than discretionary analysis.

“But Wait—Is This Just Backtesting?”

Since July 2023, we’ve been running this mechanical trading strategy live in our Discord community, posting every entry and exit in real-time. No cherry-picking. No hindsight adjustments. No theoretical performance.

And the forward-testing results have matched the backtesting.

Every trade is documented publicly, tracked in a shared Excel spreadsheet, and discussed openly with our community. You can see exactly how the strategy performs when real money is on the line, complete with the occasional losing trades and drawdown periods.

This isn’t some hypothetical system we’re selling you—it’s a strategy we use ourselves and share transparently with our community.

The strategy works because it’s based on structural forces in the options market that create predictable price movements. When those forces align with our entry criteria, we participate. When they don’t, we wait.

Simple. Systematic. Profitable.

Bottom line: $100,000 invested in January 2013 would be worth $1.45 million today using PTrans2PGEX, compared to $498,000 with SPY.

And before we move on, here is the link where you can see our trades for yourself: https://1drv.ms/x/c/37a09e23bf750b1a/EZOBBAM8eIlNj1RrNWrHrdgB8OpfLYsK79rM3PeLKFWnTg?e=kkhPth

Implementation Using GammaEdge Tools

Automated Scanning System

We’ve built comprehensive infrastructure to make PTrans2PGEX implementation effortless:

Entry Candidates:

- Command:

$PTrans2PGEX - Run after 5:45 PM EST daily

- Identifies stocks that closed above PTrans after starting below

Exit Candidates:

- Command:

$closeabovepgex - Run after 5:45 PM EST daily

- Identifies positions that closed above PGEX targets

Advanced Market Structure Concepts

Understanding Call Dominance

When PTrans is breached to the upside, it signals that call speculators have taken control of the options structure above current prices. This creates an environment where:

- Market makers become increasingly short delta as prices rise

- Hedging pressure intensifies, requiring share purchases

- Momentum acceleration becomes more likely

PGEX as Natural Target

The PGEX level represents maximum call gamma concentration—where the most short-term speculation exists. Once reached, option holders have captured significant appreciation, often leading to profit-taking that provides natural resistance.

Risk Management and Position Sizing

Why Position Sizing Matters

The 4-7% position sizing isn’t arbitrary—it’s calibrated to balance:

- Growth potential from successful trades

- Drawdown management during losing streaks

- Portfolio diversification across multiple positions

Managing Drawdowns

Like any systematic trading approach, PTrans2PGEX experiences drawdown periods. The key is maintaining discipline:

- Follow every signal without exception

- Maintain consistent position sizing

- Trust the long-term statistical edge

Common Questions About Mechanical Trading Strategies

"Won't I Miss Better Opportunities?"

The 100% mechanical trading strategy isn’t designed to catch every move—it’s designed to capture a specific type of move consistently. By focusing on options-driven price acceleration, you avoid the complexity of trying to predict all market movements.

"What About Market Conditions?"

The 12+ year backtest includes multiple market environments, proving the strategy’s adaptability. The underlying mechanics of options market structure remain consistent across different environments.

"How Does This Compare to Day Trading?"

Unlike day trading strategies that require constant attention, PTrans2PGEX operates on end-of-day signals with next-day execution. This makes it suitable for traders who can’t monitor markets constantly.

Getting Started with PTrans2PGEX Mechanical Trading Strategy

Prerequisites

- Standard brokerage account (no options trading required)

- Access to GammaEdge Discord community

- Commitment to mechanical execution

First Steps

- Join GammaEdge Community: Access scanning tools and live tracking

- Study Historical Trades: Review past performance patterns

- Start Small: Begin with reduced position sizes while learning

- Track Everything: Maintain detailed records of all trades

Tools You’ll Need

- GammaEdge Discord Access: For automated scans and community

- Position Tracking Spreadsheet: Monitor performance and risk

- Brokerage Platform: Execute trades at market open

The Psychology of Mechanical Trading

Removing Emotional Decisions

The greatest benefit of the PTrans2PGEX system is its complete removal of discretionary decisions during market hours. When signals trigger:

- No second-guessing based on market sentiment

- No position adjustments based on fear or greed

- No timing decisions beyond the mechanical rules

Building Trading Discipline

Successful implementation requires:

- Following every signal regardless of recent performance

- Maintaining position sizing during both winning and losing streaks

- Trusting the process rather than individual trade outcomes

Advanced Implementation Strategies

Portfolio Management

- Maximum concurrent positions: 10-15 trades

- Sector diversification: Avoid concentration in single industries

- Regular rebalancing: Maintain consistent position sizes

Performance Monitoring

- Weekly reviews: Track win rates and average returns

- Monthly analysis: Assess drawdown periods and recovery

- Quarterly evaluation: Compare to benchmark performance

Why Mechanical Strategies Outperform

Eliminating Human Biases

Discretionary trading suffers from predictable psychological biases:

- Confirmation bias: Seeking information that supports existing positions

- Loss aversion: Holding losers too long, cutting winners too early

- Recency bias: Overweighting recent results in decision-making

Consistency Advantage

Mechanical systems provide:

- Repeatable processes that work across market cycles

- Emotional stability during volatile periods

- Objective performance measurement without subjective interpretation

Market Structure Evolution and Strategy Adaptation

Why Options Market Structure Matters More

The explosive growth in options trading over the past decade has fundamentally changed market dynamics. Retail and institutional options activity now significantly influences stock price movements, making options-based trading strategies increasingly relevant.

Future-Proofing Your Approach

The PTrans2PGEX strategy remains robust because it’s based on fundamental market mechanics rather than temporary patterns. As long as options markets continue influencing stock prices, these structural forces will persist.

Conclusion: Your Path to Systematic Trading Success

The PTrans2PGEX mechanical trading strategy offers a proven pathway to consistent market outperformance through:

- Systematic approach that eliminates emotional decision-making

- 12+ years of validated performance across multiple market cycles

- Simple implementation using automated tools and clear rules

- Risk-adjusted returns superior to buy-and-hold strategies

Key Takeaways

- Mechanical execution beats discretionary trading for most participants

- Options market structure provides predictable patterns worth exploiting

- Consistency trumps perfection in long-term wealth building

- Simple systems often outperform complex approaches

Your Next Steps

The strategy works. The tools are ready. We track it live in Discord. The only variable left is your execution.

Ready to eliminate emotion from your trading? Join the GammaEdge community and access the complete PTrans2PGEX implementation framework, including:

- Live scanning tools and daily signals

- Historical performance data and trade logs

- Community support and educational resources

- Complete implementation guide and best practices

Bottom Line: $100,000 invested using PTrans2PGEX in January 2013 would be worth $1.45 million today, compared to $498,000 with SPY buy-and-hold.

The choice is yours: continue fighting your emotions in discretionary trading, or embrace the systematic approach that has delivered consistent outperformance for over a decade.

Disclaimer: Past performance does not guarantee future results. All trading involves risk of loss. The examples shown reflect historical backtesting and live performance but do not predict future outcomes. Consider your risk tolerance and investment objectives before implementing any trading strategy.

Related Resources: