Options Profit Targets: The Complete Guide To Taking Profits

Master options profit targets using market structure. Stop guessing where to exit with +GEX, COI, COTMP, and COTMC levels that reveal hidden profit zones.

Table of Contents

The Universal Trading Problem: When to Take Profits

You’ve mastered support and resistance, moving averages, maybe even Fibonacci levels. But have you ever wondered why price seems to stall or reverse at levels that don’t show up anywhere on your traditional charts?

Here’s the frustrating scenario every trader faces: You’re riding a strong trend, momentum is building, and there’s no obvious resistance level in sight. Then suddenly – without any catalyst or news – price hits an invisible wall and reverses hard.

- No major technical level

- No round number

- No obvious supply zone

Just a seemingly random reversal that kills your momentum and leaves you wondering “what the heck just happened?”

What you likely encountered was a critical balance point in the options market structure – hidden levels where cumulative profit-taking behavior creates predictable options profit targets that don’t show up on traditional charts.

Why Traditional Profit Targets Fall Short

Most traders rely on outdated methods for determining where to take profits:

- Arbitrary percentage gains (10%, 20%, 50%)

- Round numbers that have no market significance

- Historical support/resistance that may no longer be relevant

- Gut feelings based on recent price action

The problem? These approaches ignore the most important factor driving modern markets: options market positioning.

While you’re analyzing conventional technical indicators, there’s an entire layer of options profit targets hiding in plain sight—targets derived directly from where the collective options market has positioned itself.

Foundation: Concentration-Based Options Profit Targets

Let’s start with the fundamental options profit targets that every trader should understand. These levels represent where the largest concentrations of options speculation exist.

Your Upside Options Profit Targets

When you’re holding a long position and price is moving in your favor, you need to know where profit-taking is most likely to occur.

+GEX (Positive Gamma Exposure): Your Primary Target

What it is: The strike with the highest positive gamma in the entire options complex for the expiration periods being reviewed.

Why it matters as an options profit target: +GEX represents the focal point of maximum short-term call speculation. This level attracts price movement because it’s where the most options-based leverage is concentrated.

The trading psychology: Speculators took on out-of-the-money risk when buying these options. Let’s say the stock was trading at $100, and +GEX sits at $120. Those call buyers risked $20 of potential loss if the stock went nowhere.

Once price reaches $120, those speculators have captured all of that out-of-the-money risk. Their options are now at-the-money, they’re sitting on profits, and human nature kicks in—they want to lock in those gains.

How to use it in your trading: This level should be used as a profit target for long trades. Beyond +GEX, expect limited upward speculation as the “juice has been squeezed.” The option’s price increases at a nonlinear rate up to this level. Once through this level, the appreciation rate slows.

COI (Call Open Interest): Your Secondary Target

What it is: The strike with the highest call open interest—essentially where the collective “wisdom of crowds” expects price to go.

How it differs from +GEX: COI doesn’t have the time component that +GEX does. We don’t know if those calls expire tomorrow or next year. But what we do know is that this strike represents the largest concentration of bullish bets in the entire complex.

The trending market advantage: In proper bullish market structure, COI typically sits above +GEX, providing an excellent secondary options profit target. When +GEX is reached and then shifts higher toward COI, it signals that speculators aren’t just taking profits—they’re rolling positions higher, indicating continued bullish expectations.

Your Downside Options Profit Targets

The downside levels work exactly the same way, just in reverse.

-GEX (Negative Gamma Exposure): Your Primary Downside Target

What it is: The strike with the most negative gamma, representing the largest concentration of short-term put speculation.

How it works: Like with +GEX, speculators have captured their out-of-the-money risk when price reaches this level and are likely to take profits on their put positions.

POI (Put Open Interest): Your Secondary Downside Target

What it is: The strike with the highest put open interest, showing where the collective market expects price to decline.

The bearish trending dynamic: In strong downtrends, you’ll often see -GEX shift lower toward POI, indicating continued bearish speculation and providing deeper options profit targets for short positions.

Advanced: Balance-Based Options Profit Targets

Now that you understand concentration-based options profit targets, let’s explore a more sophisticated approach that reveals those “invisible walls” we mentioned earlier.

Understanding the Balance Point Concept

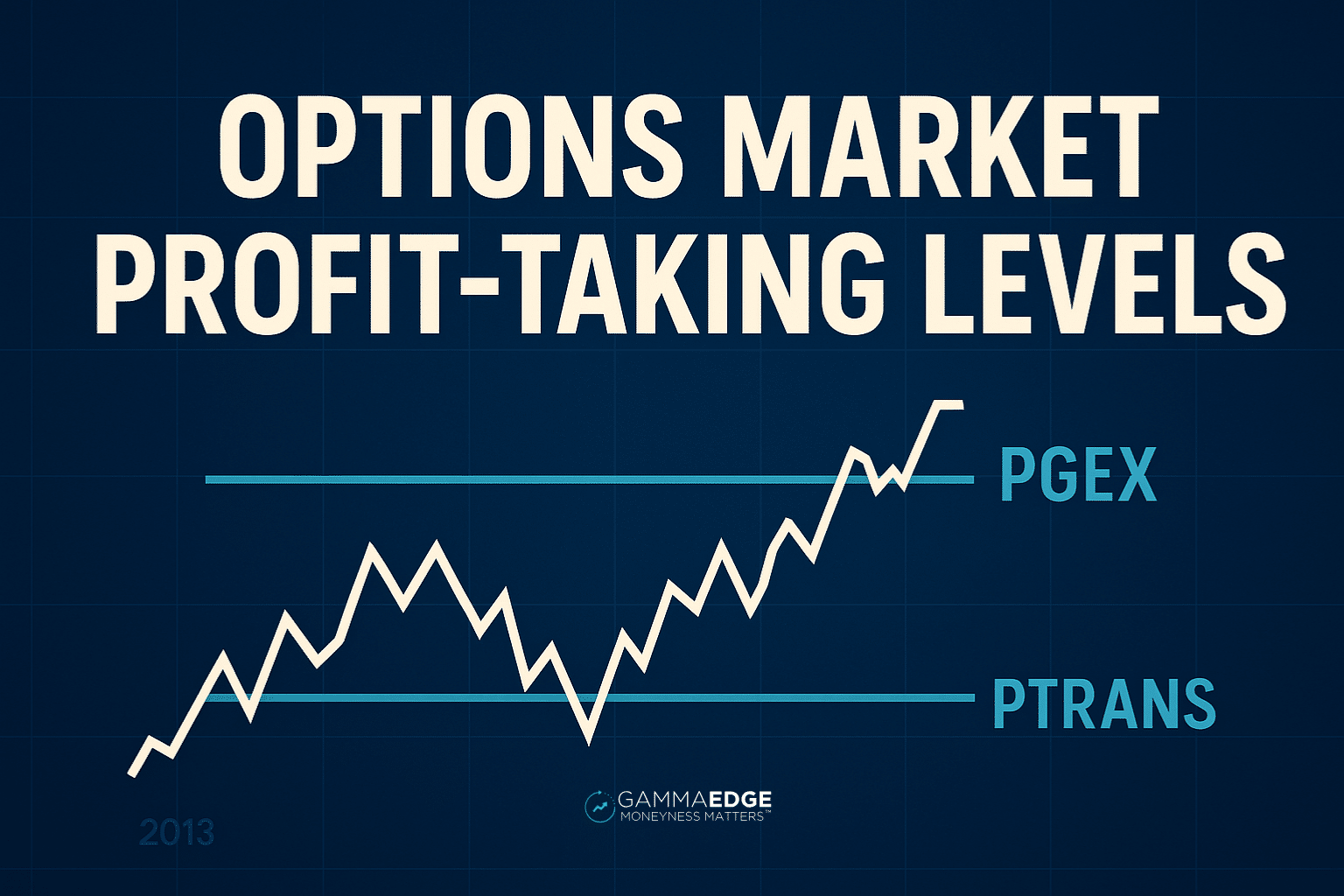

These advanced options profit targets represent critical balance points in the options market structure where cumulative profit-taking behavior creates predictable support and resistance zones.

At a high level, these levels represent when the cumulative delta exposure from out-of-the-money positions equals the delta exposure from in-the-money positions. This creates a “teeter-totter” effect—when the balance of positioning tips to favor ITM positions over OTM positions, traders holding those profitable options naturally want to cash out.

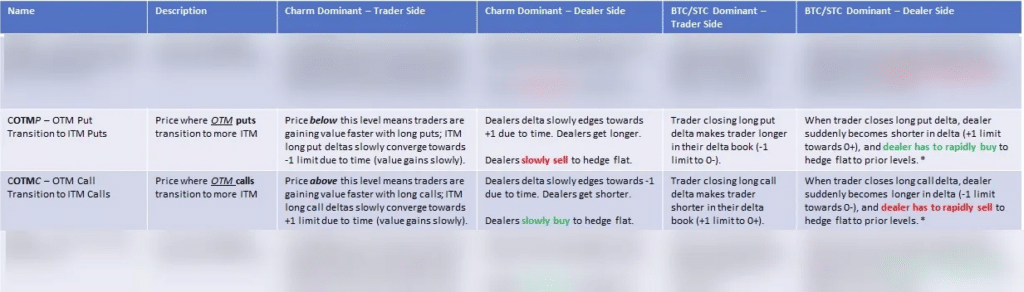

COTMC (Cumulative Out of The Money Calls): Your Advanced Upside Target

What it is: The level where out-of-the-money call deltas balance in-the-money call deltas. Price movement above COTMC shifts the moneyness profile, triggering profit-taking behavior from call holders.

Why it creates invisible resistance: Think of it this way: speculators generally open long OTM positions expecting spot price will move toward their strike. A trader purchasing 20-delta calls experiences validation as those positions appreciate and approach 50-delta territory (i.e., at-the-money). The natural inclination is to realize those gains.

COTMC represents the tipping point when the bulk of existing options flip from OTM to ITM, triggering that natural impulse to sell and protect profits across the market.

COTMP (Cumulative Out of The Money Puts): Your Advanced Downside Target

What it is: The balance point where out-of-the-money put deltas equal in-the-money put deltas. As spot price moves below this level, OTM puts transition to ITM, creating a natural monetization zone.

The profit-taking psychology: These levels represent crucial inflection points driven by options market psychology and the natural human tendency to protect profits when speculative positions move in-the-money.

The key insight for active traders is recognizing these levels as areas where collective profit-taking behavior can overwhelm directional momentum—even in strongly trending markets.

Implementing Your Complete Options Profit Targets System

Daily Preparation Framework

Morning Analysis:

- Execute your morning analysis using the Web App Dashboard (or the $EM command for basic levels, $s command for advanced)

- Note any significant gaps relative to pre-market calculations

- Assess whether news events might affect normal options profit targets behavior

Level Hierarchy:

- Primary upside: +GEX (concentration) and COTMC (balance)

- Secondary upside: COI (longer-term positioning)

- Primary downside: -GEX (concentration) and COTMP (balance)

- Secondary downside: POI (longer-term positioning)

Intraday Execution Strategy

Approaching Upside Targets:

- +GEX approach: Anticipate potential resistance as call holders secure profits

- COTMC breach: Monitor for potential distribution as the balance tips to ITM calls

- COI extension: Use as ultimate target in trending markets

Testing Downside Targets:

- -GEX approach: Watch for potential support as put holders exit profitable positions

- COTMP breach: Monitor for acceleration as balance shifts to ITM puts

- POI extension: Deeper target for continued weakness

When Market Structure Breaks Down

Understanding limitations is crucial for professional application. These options profit targets function as “sensitivity points” rather than absolute support/resistance lines.

Warning Signs:

- Significant gaps above COTMC or below COTMP often indicate larger market forces overwhelming normal options-driven structure

- High volatility events (FOMC, earnings, major news) can completely overwhelm these levels

- Low volume periods may not have enough participation to make these levels meaningful

Adaptation Strategy: When levels are breached decisively, shift focus to volume-based tools and reassess whether market structure has changed.

Common Questions About Options Profit Targets

"What if price doesn't respect these levels?"

No level works 100% of the time. The key is understanding that options profit targets work best as part of a complete framework, not in isolation.

Look for confluence with transition zone analysis and overall market trend. Remember, these are profit-taking zones, not rigid walls. Sometimes price moves right through them, especially in strongly trending environments—which provides valuable information that the move has more potential than expected.

"How do I know which timeframe to use?"

The beauty of options profit targets is that they’re fractal, meaning they work across multiple timeframes. The key is matching them to your trading style:

Day traders: Focus on shorter-term expirations where gamma is most concentrated Swing traders: Look at weekly and monthly expirations where larger positioning typically resides

"What does it mean when levels shift intraday?"

As we progress through the day, intraday action moves the COTMP/COTMC values from premarket calculations—moneyness changes as spot price moves and time passes. This is where volume analysis and market trend tools become critical.

If we drop below COTMP by a significant amount, the chance of recovery wanes. It’s critical to understand if we’re seeing further expansion via intraday volume analysis.

Putting It All Together: Your Complete System

These options profit targets give you what most traders are missing: objective, market-derived exit points based on actual positioning rather than subjective chart patterns.

Key Implementation Steps

- Start with Foundation: Master +GEX, COI, -GEX, and POI identification

- Add Advanced Concepts: Incorporate COTMP and COTMC balance points

- Practice Integration: Use both concentration and balance-based targets together

- Monitor Evolution: Track how targets shift to gauge trend strength

- Maintain Discipline: Follow predetermined target strategy even when emotions suggest otherwise

Risk Management Protocol

- Treat these as zones rather than precise lines

- Use partial profit strategies at primary targets

- Hold remainder for secondary targets in trending markets

- When levels are breached decisively, reassess market structure

The Competitive Advantage

While other traders guess where to take profits or rely on outdated technical methods, you now have access to the same options profit targets that institutional traders monitor. This information edge can significantly improve your exit timing and overall trading performance.

The key insight: These levels work because they represent where real money is positioned in the market. When thousands of traders have bet on a move to specific strikes, that creates genuine supply and demand dynamics that traditional technical analysis simply can’t capture.

Understanding where collective profit-taking pressure is likely to emerge gives you a significant edge in timing entries, managing existing positions, and setting realistic options profit targets based on market structure rather than arbitrary technical levels.

Your Next Steps

Ready to stop guessing where to take profits? Here’s your action plan:

- Review the concepts: Understand both concentration and balance-based options profit targets

- Start observing: Begin tracking these levels on your current watchlist

- Practice identification: Focus on +GEX/COI for bullish setups, -GEX/POI for bearish ones

- Add advanced tools: Incorporate COTMP/COTMC for sophisticated analysis

- Integrate gradually: Start using these as profit targets alongside your existing strategy

The combination of concentration-based and balance-based options profit targets creates a complete trading system based on market structure rather than guesswork.

Ready to access professional-grade options analysis tools and systematic trading education? The GammaEdge Fastpass provides comprehensive training on options market structure analysis, including real-time tools for identifying options profit targets and complete methodologies for systematic market analysis.

Transform your exit strategy from guesswork to precision. Your trading account will thank you.