Build Better Watchlists, Time Better Entries, And Hold Winning Trades Longer

Our tools show you which stocks to trade, when to trade them, and where to get in—all based on what’s happening in the options market that your charts can’t show

(And NO! You don’t have to trade options yourself to use this—we do the analysis, you get the edge)

Is GammaEdge Right For Me?

GammaEdge isn’t for everyone. But if you’re a swing trader facing any of these challenges, we built our tools specifically for you:

Do you struggle to know when market conditions actually favor swing trades?

Some weeks everything works. Other weeks every trade feels like swimming upstream. What if you could see ahead of time whether the market environment supports sustained directional moves—before you risk a dollar?

Do you spend hours scanning charts hoping to find something that “looks good”?

Building watchlists shouldn’t be a guessing game. What if you could filter for stocks with structural backing from options market positioning—so you know which setups have real support for sustained moves?

Do you struggle with when to exit—taking profits too early or holding too long?

Without clear profit targets, you’re guessing when to exit. What if you knew exactly where options speculators are positioned and where profit-taking is likely to occur, giving you precise levels to manage your trades?

If you said ‘yes’ to any of these, GammaEdge reveals what your charts can’t—where options speculators are positioned and how that positioning drives the multi-day price movements you’re trying to capture

See GammaEdge Swing Trading In Action

Your technical analysis shows you what’s happening on the charts—breakouts, support levels, volume patterns. And that’s valuable.

But there’s a layer beneath the charts that determines which setups will actually work—and which won’t.

Options market positioning.

Over the past decade, options trading has exploded. Retail and institutional traders alike are placing massive bets through the options market, and those bets create structural forces that either support or resist the moves you’re trying to catch. This is why some of your technical setups work flawlessly while identical patterns fail.

Here’s what that means for you: GammaEdge shows you where speculators are positioned and whether that positioning supports or fights against your trade—before you risk a dollar.

When speculators pile into calls on a stock, market makers must hedge by buying shares. That creates structural support for upward moves. When positioning shifts, so does that support—often before it shows up in price.

Your charts can’t show you this. GammaEdge can.

We give you four edges:

- Know WHEN to trade: See when market conditions actually support sustained directional moves (so you’re not fighting the current)

- Know WHAT to trade: Build watchlists of stocks where options positioning shows structural backing (not just pretty chart patterns)

- Know WHERE to enter and exit: Use levels derived from where speculators are positioned (not arbitrary support/resistance)

- Know HOW to manage positions: Monitor whether structural support is strengthening or weakening (so you hold winners longer and exit losers earlier)

Watch this video to understand exactly how GammaEdge transforms swing trading decision-making:

What Changes When You Start Trading With GammaEdge

Imagine starting your trading day with clarity instead of confusion.

You’re not spending hours scrolling through charts hoping something jumps out at you. Instead, you run a quick scan and instantly see which stocks have structural backing from options positioning. Your watchlist is built in minutes, not hours—and every name on it has real support, not just a pretty pattern.

You check the Market Trend Model and know immediately whether today’s environment favors swing trades or if you should stay on the sidelines. No more forcing trades when conditions don’t support sustained moves.

When you find a setup you like, you’re not guessing where to enter. You see exactly where the transition zone is—where speculators take control—and you time your entry with precision.

And once you’re in the trade? You’re not paralyzed by indecision. You have the tools to monitor the options market dynamics to see if structural support is strengthening or weakening. When your winners are working, you hold them with confidence because the data confirms your thesis. When structure deteriorates, you exit cleanly without the emotional tug-of-war.

This is what swing trading looks like when you’re not guessing:

- Confidence in your entries because you know market structure supports your thesis

- Clarity on which stocks to trade because you see where speculators are positioned

- Control over your exits because you have objective data, not just gut feelings

- Consistency because you’re trading with structural forces, not fighting against them

You’re still using your technical analysis. You’re still the decision-maker. But now you’re doing it with the clarity that comes from seeing what’s happening beneath the charts.

You’re not guessing anymore. You’re trading with structure on your side.

Does The Framework Actually Work? Here's The Proof

We don’t just teach theory—we prove it works with real money.

Using the exact same GammaEdge tools and framework you’ll get access to, we built a fully mechanical swing trading strategy called PTrans2PGEX. It uses our transition zones for entries, key levels for exits, and the Market Trend Model for timing.

The results over 12+ years:

- 1,348% returns vs SPY’s 398%

- 75.55% win rate across 1,783 trades

- Tracked live in our Discord since July 2023—every trade posted in real-time, no cherry-picking

We’re not saying you need to trade this exact strategy. We’re showing you that when you apply the GammaEdge framework systematically, the edge is real and measurable.

You’re getting the same tools. What you do with them is up to you. Whether you trade mechanically like PTrans2PGEX or use the tools to enhance your discretionary decisions, the edge is the same—you’re seeing what your charts can’t show.

The Four Tools That Give You An Edge

GammaEdge doesn’t just give you tools—it helps you achieve the trading success you’ve been striving for. Here are the tools & benefits you can expect once each of our pillars are integrated into your trading system:

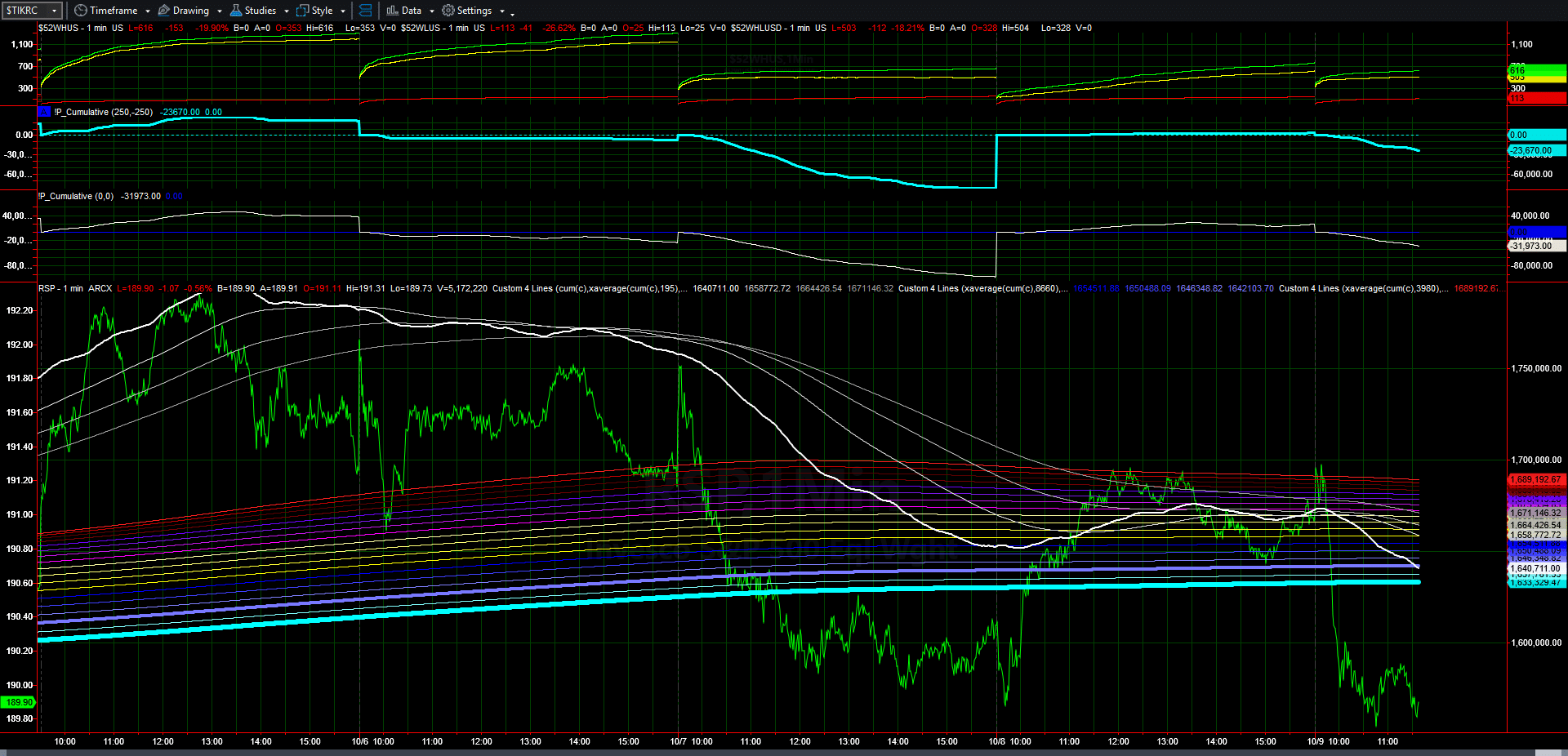

The Market Trend Model shows you real-time momentum across multiple timeframes—so you know whether market conditions support swing trades or if you should sit on the sidelines.

- Stop forcing trades when the market’s against you – See whether conditions support sustained moves before you risk a dollar

- Enter with confidence knowing momentum is on your side – Understand if you’re trading with a tailwind or fighting a headwind

- Avoid the frustration of “nothing’s working” weeks – Know when to step aside because market structure doesn’t favor swing trades

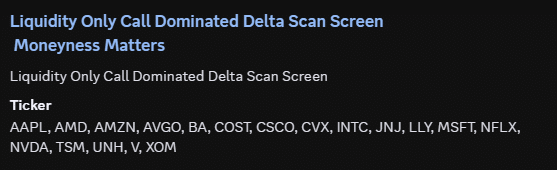

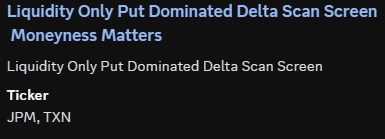

Our proprietary scanners filter for stocks where options positioning shows structural backing—so you’re not wasting hours scrolling through charts hoping to find something that “looks good.”

- Build better watchlists in minutes, not hours – Stop scrolling through endless charts hoping something jumps out

- Trade stocks with structural backing, not just pretty patterns – See which names have real options positioning supporting your directional bias

- Focus on high-probability setups – Filter for stocks where speculators are already positioned, so you’re not guessing

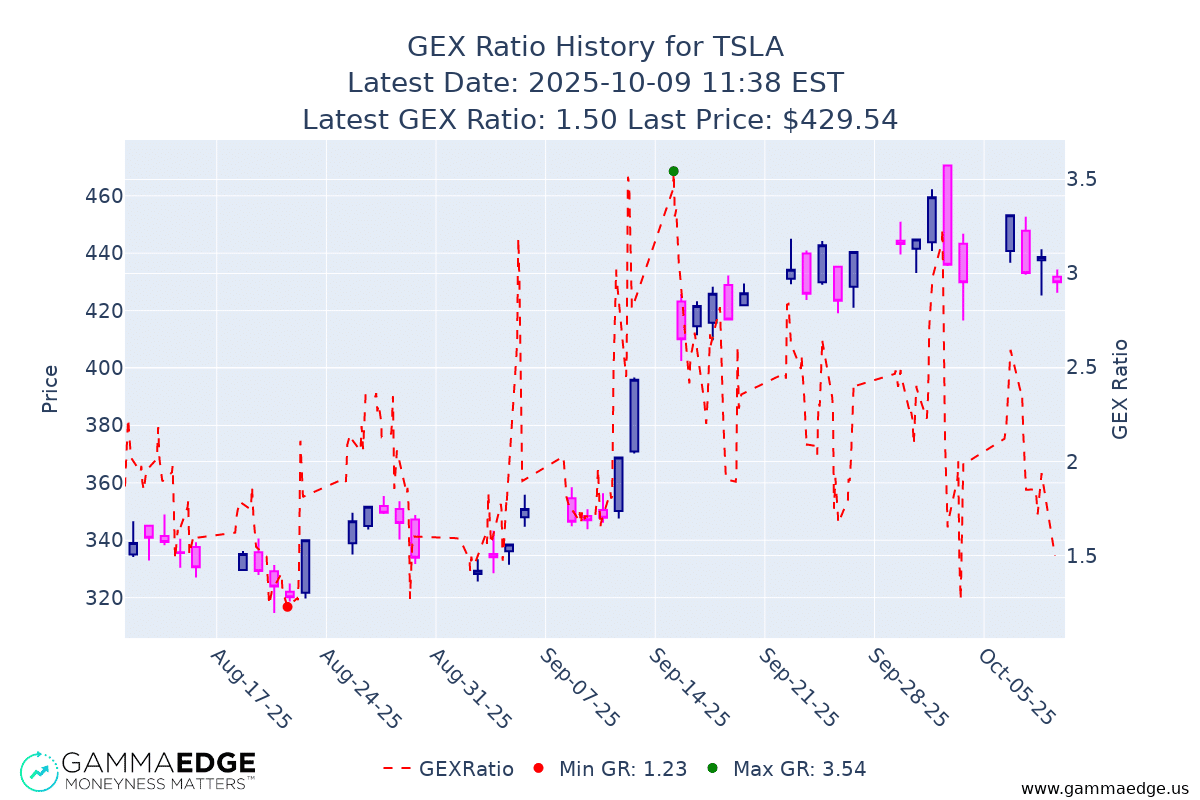

The GammaEdge Web App is a powerful visual representation of the underlying’s options market, allowing you to identify the precise levels to time your trades for more profitable entries AND exits.

- Time your entries with precision – See exactly where speculators take control and where market structure shifts

- Know where to take profits before you enter the trade – Identify the natural profit-taking zones based on where the largest options bets sit

- Stop guessing on support and resistance – Use levels derived from actual speculator positioning, not arbitrary lines on a chart

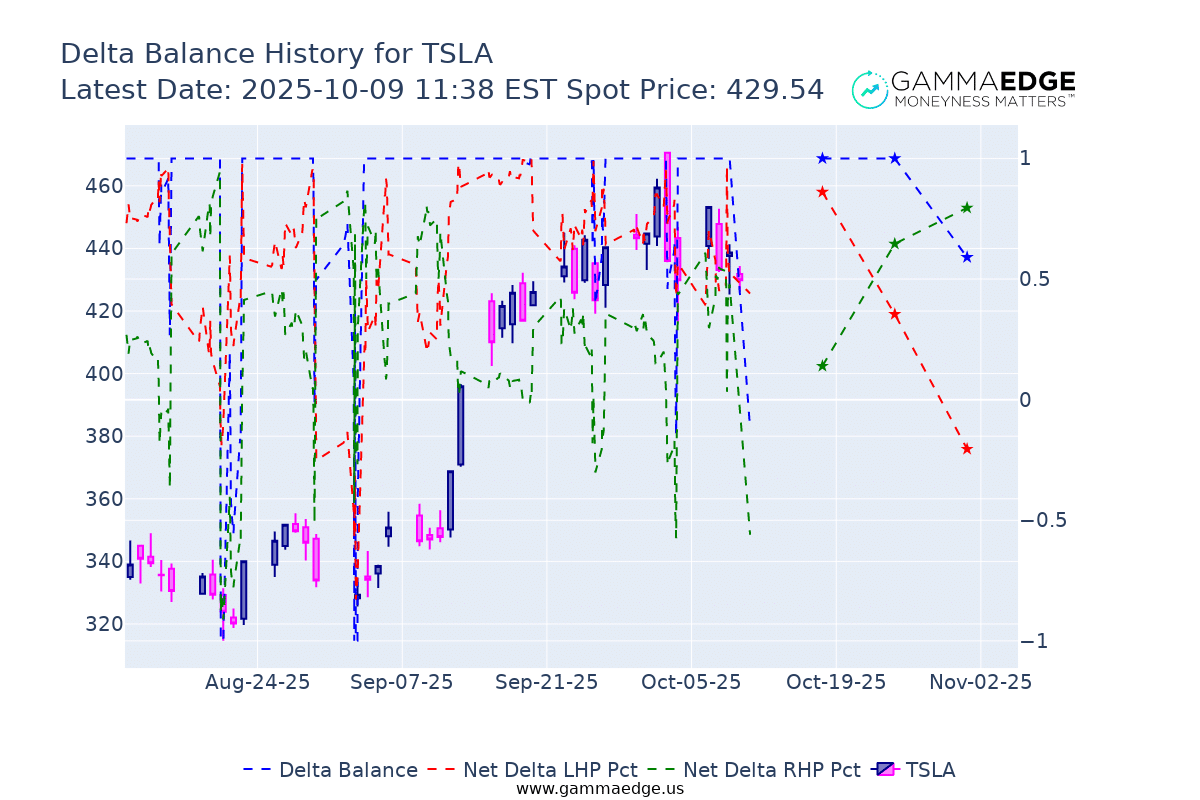

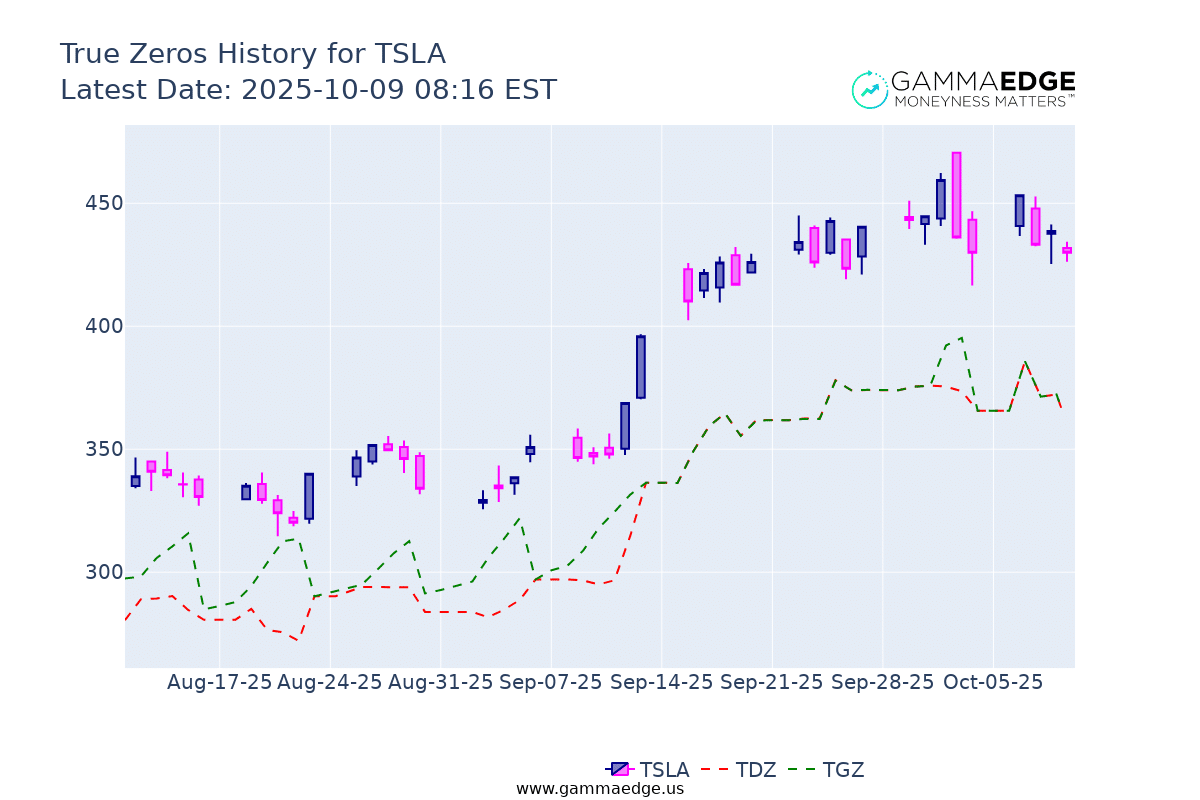

Our custom charting bots generate interactive visualizations that reveal critical data about the options market’s structure and sentiment.

- Hold winners longer with confidence – See when structural support is intact so you don’t cut profits short

- Exit losers earlier without the emotional tug-of-war – Know when positioning has shifted against you and it’s time to get out

- Make position management decisions based on data, not gut feelings – Monitor whether speculators are adding or exiting in real-time

What The Community Is Saying

Refund Policy

If you don’t make one profitable trade, worth $150 using the GammaEdge system within the first month, and you’ve gone through The GammaEdge Framework in its entirety, we’ll give you a full refund after you request to cancel your membership.

We’ll just ask you to answer one question—a brief statement on where we missed the mark so we can work to improve the GammaEdge experience.

Frequently Asked Questions

Q: Is this just another signal service?

No. We don’t give you buy or sell signals. We don’t tell you which trades to take.

GammaEdge gives you the tools and framework to make better decisions on your own. You’re still the decision-maker. You’re still using your own strategy and analysis. We just give you the missing layer—options market positioning—so you can see which setups have structural backing and which don’t.

Think of it like adding X-ray vision to what you’re already doing, not replacing your process with ours.

Q: Do I need to be glued to my screen all day? How much time does this actually take?

Not at all. This is built for swing traders, not day traders.

Here’s what a typical routine looks like:

- Morning (5-10 minutes): Check the Market Trend Model to see if conditions favor swing trades. Run a quick scan to see which stocks have structural backing.

- Throughout the day (optional): Monitor your positions using tools provided by GammaEdge.

- End of day (5 minutes): Evaluate if your thesis is still intact based on how the session played out.

You’re not monitoring tick-by-tick. You’re checking in at key moments to make informed decisions. Most members spend 10-20 minutes per day using the tools—unless they want to go deeper.

Q: What if I'm new to options or don't trade them directly?

You don’t need to trade options to benefit from GammaEdge. Our members trade shares, future, and options.

We analyze the options market to give you intelligence about positioning and structural forces. You use that intelligence to make better decisions in whatever you’re trading—stocks, ETFs, futures, whatever.

Think of it this way: You don’t need to be a meteorologist to check the weather forecast. You just need to know if it’s going to rain. Same concept here—we do the options analysis, you use the insights.

Q: Will this work with my existing strategy?

A: Yes. GammaEdge is designed to complement what you’re already doing, not replace it. In fact, many of our most successful members are experienced traders who already had profitable strategies—they just wanted to take their edge to the next level.

If you’re a technical trader, you’ll still use your chart patterns and indicators. If you follow fundamentals, you’ll still do that. If you have a systematic approach, keep it.

GammaEdge just adds the layer your current analysis can’t show—where options speculators are positioned and how that creates structural forces. You’re enhancing your edge, not starting over.

Hundreds of our members integrate GammaEdge into completely different strategies. The framework is flexible.

Q: How does GammaEdge support me? Will I be left to figure this out on my own?

Not a chance. We don’t just throw tools at you and say “good luck.”

Here’s what you get from day one:

- The GammaEdge FastPass – Our comprehensive onboarding course that walks you through the entire framework step-by-step. No assumptions. No jargon overload. Just clear education on how to use each tool and integrate it into your trading.

- Daily market analysis – Every morning, the GammaEdge team posts pre-market commentary breaking down what we’re seeing in the structure, what to watch, and how to apply the framework to current conditions. You’re not interpreting data in a vacuum.

- Active moderators and admin – We’re in the Discord daily. Ask questions, share trades, get feedback. This isn’t a ghost town where you’re shouting into the void. We’re approachable, responsive, and here to help you actually use the tools.

- A real community – Hundreds of other traders using the same framework, sharing observations, and helping each other improve. You’re not alone in this.

Bottom line: You’re joining a supported community with real education and real people—not buying a software subscription and getting ghosted.

Q: Can I cancel anytime? What if I don't make a profitable trade?

Yes, you can cancel anytime. No long-term commitment.

You get a 14-day free trial with full access to everything—all tools, all education, the entire community.

After the trial, if you continue, you’re on a monthly or annual membership. Cancel whenever you want.

Our refund policy: If you don’t make one profitable trade worth $150 (the cost of membership) using the GammaEdge system within the first month, and you’ve gone through The GammaEdge FastPass (our education course) in its entirety, we’ll give you a full refund after you request to cancel.

NOTE, an annual membership will not be refund after the 30-day refund window).

We’ll just ask you to answer one question—a brief statement on where we missed the mark so we can improve.

Bottom line: We only win if you win. If the tools don’t help you make better trades, you shouldn’t pay for them.

Ready To Trade Swing Setups With Structural Backing?

You’ve seen the framework. You’ve seen the proof. You’ve seen the tools.

Now the only question is: Are you ready to stop guessing on swing trades and start trading with the same options market intelligence that drives sustained price movements?

Here’s what happens when you join:

- Instant access to all tools—Market Trend Model, Equity Scanners, Web App, Discord Bots, everything

- The GammaEdge FastPass – Full onboarding course that walks you through the framework step-by-step

- Daily pre-market analysis from the GammaEdge team so you know what to watch and how to apply the tools

- A community of hundreds of traders using the same framework, sharing insights, and improving together

- 14-day free trial. Cancel anytime.

And if you don’t make one profitable trade worth $150 using the system within your first month (after completing the FastPass), we’ll refund you in full. No questions asked—just tell us where we missed the mark so we can improve.

You’re not risking anything. The only risk is staying where you are—guessing on trades, forcing setups in bad conditions, and cutting winners too early because you don’t have the full picture.

Join hundreds of traders already using GammaEdge to build better watchlists, time better entries, and hold winners longer.

We train traders to simplify the options markets with our industry leading data, tools, and education to achieve profitability.

Products

Quick Links

Get In Touch

email: contactus@gammaedge.us