Know When To Trade, Where To Enter, And When To Step Aside

Our tools show SPX 0DTE & Futures Traders when market conditions favor directional moves vs. chop, which levels to target, and where to time entries—all based on real-time options market positioning

(And NO! You don’t have to trade options yourself to use this—we do the analysis, you get the edge)

Is GammaEdge Right For Me?

GammaEdge isn’t for everyone. But if you’re a swing trader facing any of these challenges, we built our tools specifically for you:

Do you struggle to tell if today’s a trend day, chop day, or reversal day?

Some sessions price moves clean and directional. Other days you get chopped up in a range. And then there are the days when the market flips mid-session and catches you on the wrong side.

What if you could read real-time options volume and momentum to identify the market’s character as it develops—so you know whether to press directional trades, stay tight, or step aside entirely?

Are you guessing where to enter, exit, and set stops—without clear levels to guide you?

You see price moving, but you don’t know where the natural profit targets sit. You enter a trade but have no idea where the acceleration zones are. You set arbitrary stops that get hit right before the move works.

What if you had precise levels derived from where options speculators are actually positioned—showing you where to target profits, where entries have the highest probability, and where structure breaks down?

Do you walk into each session without a clear gameplan—reacting instead of executing?

You’re scrambling to figure out what to watch, where price might go, and what conditions to expect. By the time you have a plan, the best opportunities are already gone.

What if you started every session with a clear understanding of key levels, potential market character, and exactly what you’re watching for—so you’re executing a plan instead of guessing in real-time?

If you said ‘yes’ to any of these, GammaEdge reveals what your charts can’t—where options speculators are positioned in real-time and how that positioning drives intraday price action you’re trying to capture.

How GammaEdge Helps You Trade Intraday With Clarity

You’re already watching price action, volume, and maybe some technical indicators. And that gives you part of the picture.

But here’s what those tools can’t show you: where SPX 0DTE options speculators are positioned in real-time, and how that positioning creates the forces that drive intraday price movements.

When 0DTE call speculators pile into strikes above current price, market makers must hedge by buying—creating upward pressure. When those positions shift or unwind, the support disappears—often before it shows up on your chart.

Your price chart shows you what happened. Options market positioning shows you what’s happening right now and where it’s likely headed next.

GammaEdge gives you three critical edges for intraday trading:

- Know WHEN to trade — See if today’s a trend day, chop day, or reversal day as market character develops in real-time (so you’re not fighting conditions that don’t support your strategy)

- Know WHERE to enter and exit — Use levels derived from where speculators are actually positioned—natural profit targets, acceleration zones, and structural breakdown points (not arbitrary chart levels)

- Know HOW to execute your gameplan — Start every session with clear pre-market analysis showing key levels, potential market character, and exactly what you’re watching for (so you’re executing a plan, not reacting in chaos)

Want to see exactly how this works in practice?

Watch this video where we walk through the GammaEdge 0DTE framework and show you real examples of how options market analysis transforms your intraday decision-making:

What Changes When You Start Trading With GammaEdge

Imagine starting your trading session with a clear gameplan instead of scrambling to figure out what to watch.

You review your pre-market analysis and immediately see the key levels for the day—where acceleration zones sit, where profit targets are, and where structure breaks down. You know what market character to expect and what signals to watch for.

The opening bell rings. Instead of guessing, you’re watching real-time volume flow and momentum indicators to confirm if today’s developing into a trend day or chop day. When the market shows its hand, you execute your plan with confidence.

You see price approaching a key level. You’re not guessing if it’ll hold or break—you know where options speculators are positioned and whether that level has structural backing. You enter with precision, not hope.

Mid-session, sentiment shifts. Instead of panicking or freezing, you see the structural change developing in real-time through volume analysis and positioning data. You adapt cleanly—either adjusting your thesis or stepping aside—without the emotional tug-of-war.

When you hit your profit target, you exit confidently because you know where the natural monetization zones sit. You’re not cutting winners early or holding too long hoping for more.

This is what intraday trading looks like when you’re not guessing:

- Clarity on market character so you know which strategy to deploy each session

- Precision on entries and exits because you’re using levels that price actually respects

- Confidence in your decisions because you see what’s happening beneath the charts in real-time

- Control over your execution because you’re trading with a plan, not reacting to chaos

You’re still making the decisions. You’re still using your analysis. But now you have the missing layer that separates trades that work from those that don’t.

The Four Tools That Give You An Edge

GammaEdge doesn’t just give you tools—it gives you the edge to trade smarter. Here’s what you get when you integrate our framework into your intraday trading:

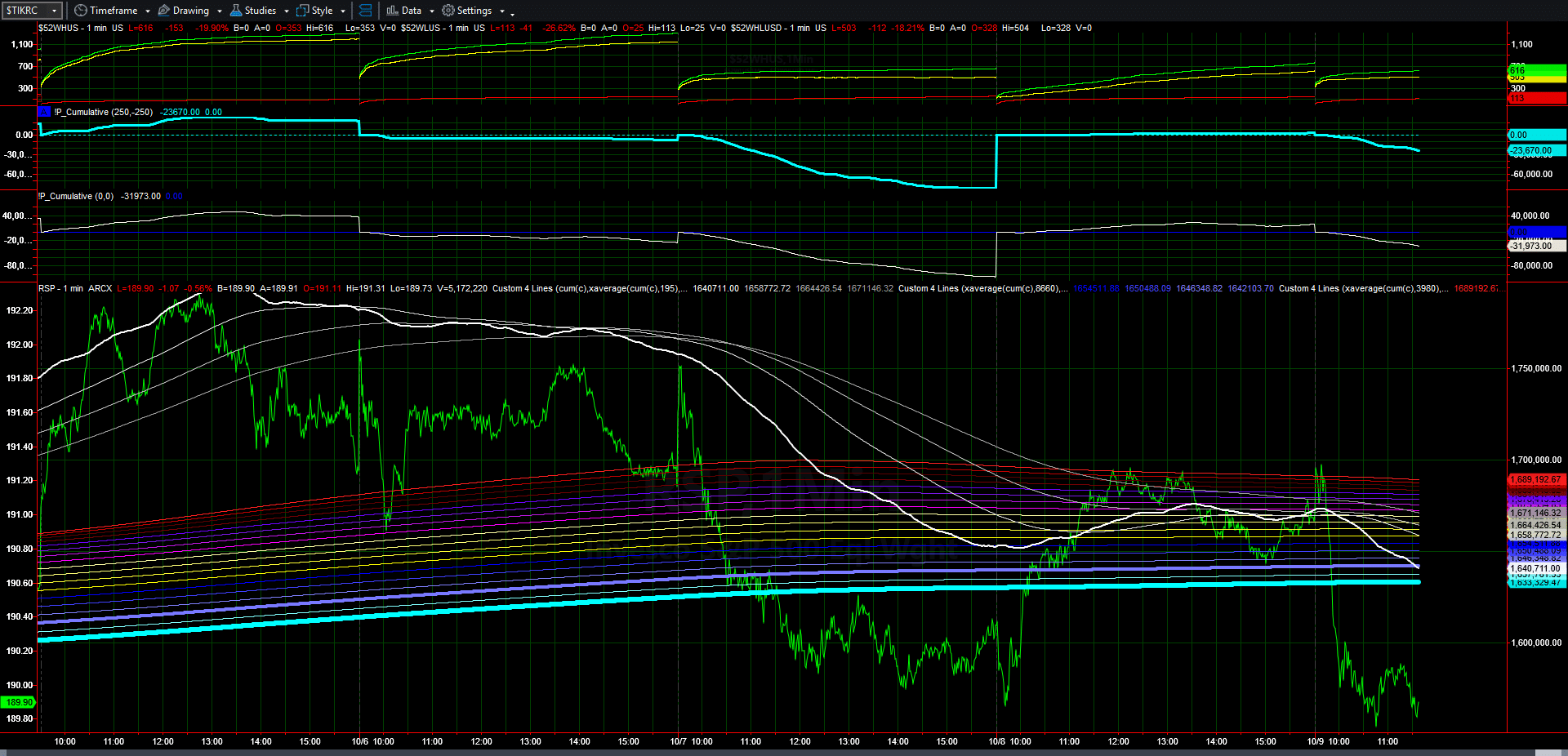

Our Market Trend Model and SPX 0DTE Intraday Volume Analysis show you real-time momentum and speculator behavior—so you know if today’s a trend day, chop day, or reversal day as market character develops.

- Stop getting chopped up on range-bound days: Identify when conditions don’t support directional trades so you can step aside or adjust your strategy

- Enter with conviction when momentum is on your side: See real-time buying and selling pressure so you know when to press directional moves

- Catch reversals before they’re obvious in price: Track shifts in speculator behavior as price turns

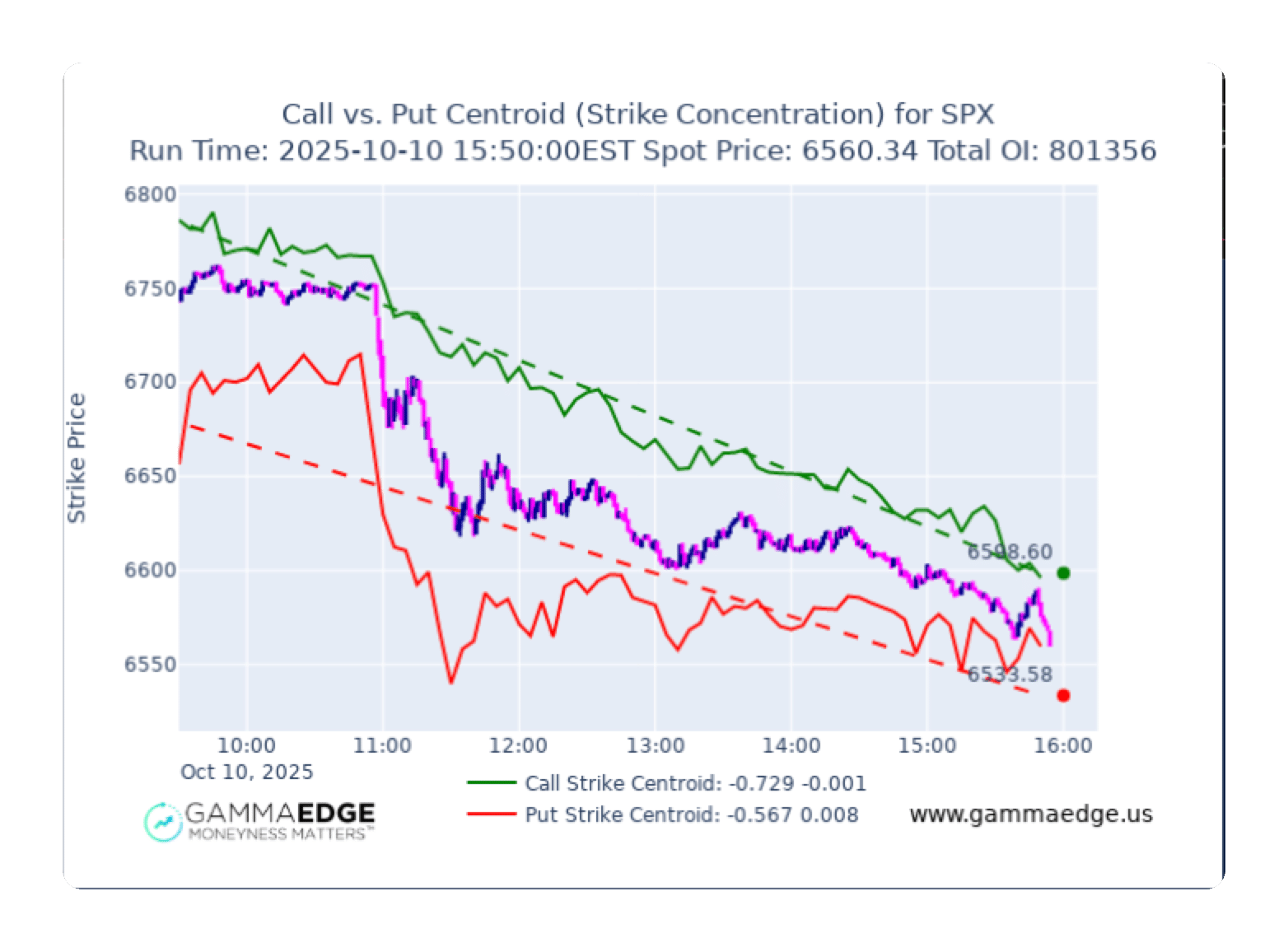

We identify the precise levels derived from where options speculators are actually positioned—showing you natural entry zones, profit targets, and where structure accelerates or breaks down.

- Know exactly where to take profits before you enter the trade: Target levels where speculators are likely to monetize, so you’re not guessing when to exit

- Time your entries at acceleration zones, not arbitrary chart levels: Enter where market structure shifts and momentum is most likely to follow through

- Set intelligent stops based on structural breakdown points: Know where your thesis is invalidated, not just where a random percentage below entry sits

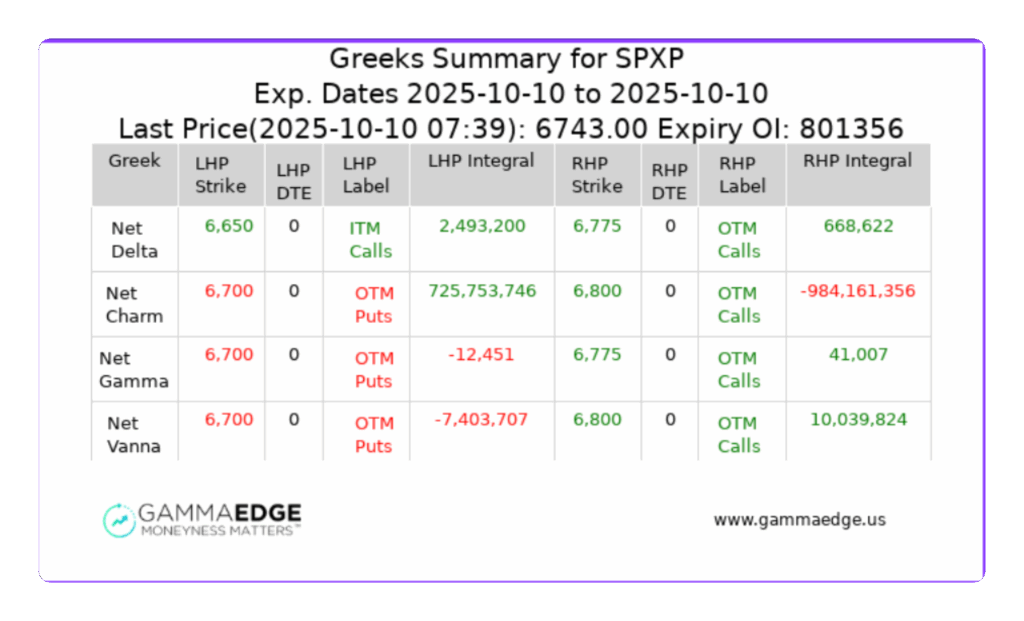

Our NetStat tool distills complex 3D Greek surface models into a simple snapshot—showing you where options speculators are concentrated, which strikes have the most influence, and where market maker hedging pressure will push price.

- See where price will accelerate before it happens: Identify key strikes where large speculator positioning will trigger rapid market maker hedging flows

- Know who’s in control of the market right now: Understand whether calls or puts dominate above and below current price, so you’re trading with the momentum

- Spot structural weakness or strength in real-time: Monitor how positioning shifts throughout the session so you know when your thesis is intact or breaking down

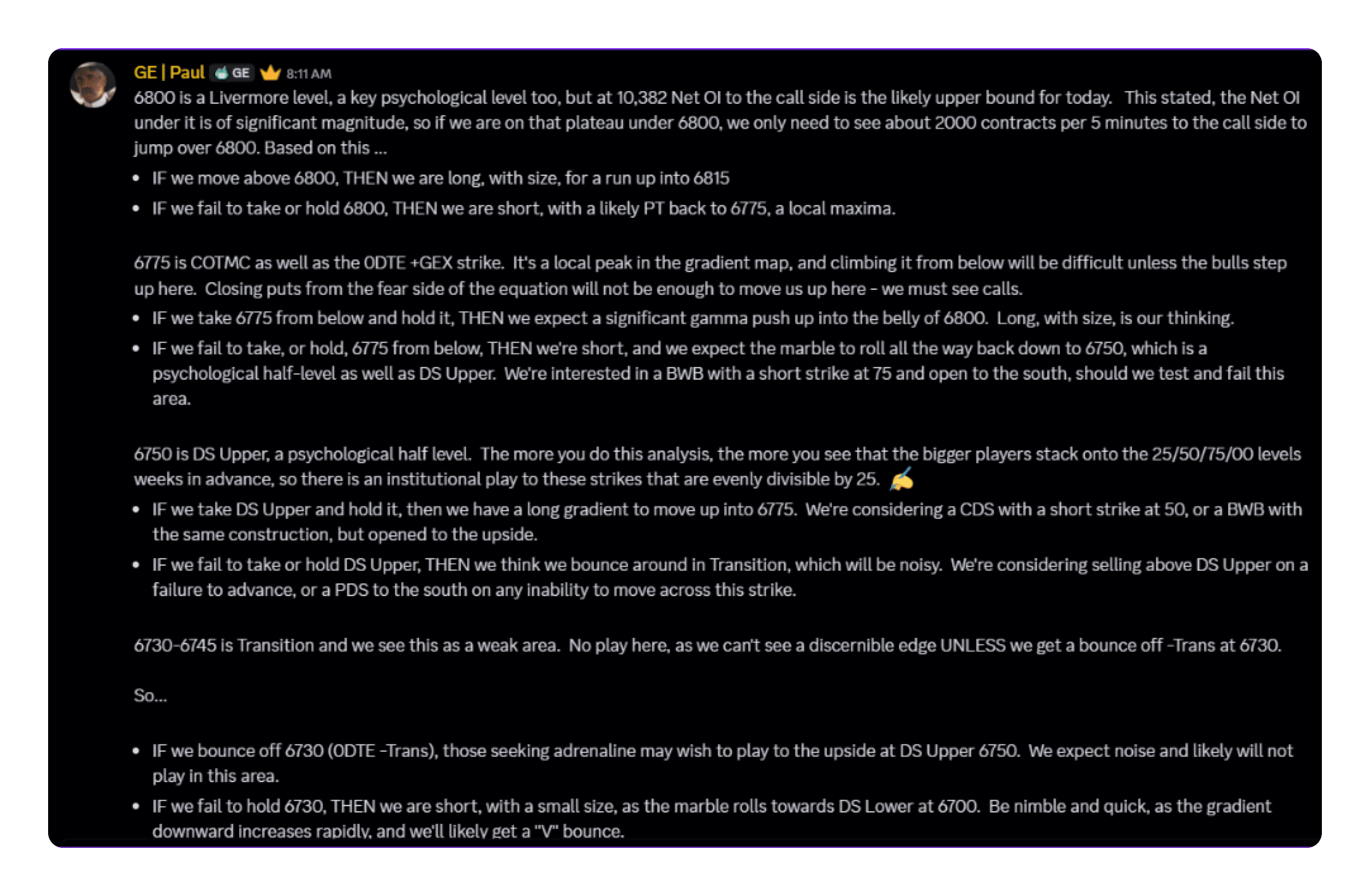

Every morning before the market opens, the GammaEdge Admin Team posts in-depth pre-market analysis walking through what all our tools are showing and what to watch for the session ahead.

- Start every session with a clear plan, not chaos: Know the key levels, expected market character, and exactly what you’re watching before the opening bell

- Understand what today’s structure is telling you: Get expert interpretation of the tools so you’re not flying blind trying to figure it out yourself

- Execute with confidence instead of second-guessing: Trade from a position of preparation, not reaction

What The Community Is Saying

Refund Policy

If you don’t make one profitable trade, worth $150 using the GammaEdge system within the first month, and you’ve gone through The GammaEdge Framework in its entirety, we’ll give you a full refund after you request to cancel your membership.

We’ll just ask you to answer one question—a brief statement on where we missed the mark so we can work to improve the GammaEdge experience.

Frequently Asked Questions

Q: Is this just another signal service?

No. We don’t give you buy or sell signals. We don’t tell you which trades to take.

GammaEdge gives you the tools and framework to make better decisions on your own. You’re still the decision-maker. You’re still using your own strategy and analysis. We just give you the missing layer—options market positioning—so you can see which setups have structural backing and which don’t.

Think of it like adding X-ray vision to what you’re already doing, not replacing your process with ours.

Q: Do I need to be glued to my screen all day? How much time does this actually take?

That depends on your trading style, but our tools are designed to give you clarity without requiring constant monitoring.

For active 0DTE traders:

- Pre-market analysis (5-10 minutes) sets up your gameplan for the session

- Monitor key tools (Market Trend Model, Volume Analysis) at critical decision points throughout the day

- You’re checking structure at key moments, not staring at screens constantly

For futures traders or those with day jobs:

- Many members check structure in the morning, set alerts at key levels, and trade around their schedule

- The tools show you WHEN conditions favor trades vs. when to step aside

You’re not required to watch every tick. You’re checking in at the moments that matter.

Q: What if I'm new to options or don't trade them directly?

You don’t need to trade options to benefit from GammaEdge. Our members trade shares, future, and options.

We analyze the options market to give you intelligence about positioning and structural forces. You use that intelligence to make better decisions in whatever you’re trading—stocks, ETFs, futures, whatever.

Think of it this way: You don’t need to be a meteorologist to check the weather forecast. You just need to know if it’s going to rain. Same concept here—we do the options analysis, you use the insights.

Q: Can I use this with futures (ES, NQ)?

Absolutely. Many GammaEdge members analyze SPX options structure and market character, then execute their trades through ES or NQ futures.

The key levels, volume analysis, and market character assessments we identify apply equally to futures price action since both markets reflect the same underlying index. You get the predictive insights from options positioning combined with the simplicity and capital efficiency of futures trading.

Whether you’re trading SPX options, ES futures, or NQ—the structural analysis is the same.

Q: How does GammaEdge support me? Will I be left to figure this out on my own?

Not a chance. We don’t just throw tools at you and say “good luck.”

Here’s what you get from day one:

- The GammaEdge FastPass – Our comprehensive onboarding course that walks you through the entire framework step-by-step. No assumptions. No jargon overload. Just clear education on how to use each tool and integrate it into your trading.

- Daily market analysis – Every morning, the GammaEdge team posts pre-market commentary breaking down what we’re seeing in the structure, what to watch, and how to apply the framework to current conditions. You’re not interpreting data in a vacuum.

- Active moderators and admin – We’re in the Discord daily. Ask questions, share trades, get feedback. This isn’t a ghost town where you’re shouting into the void. We’re approachable, responsive, and here to help you actually use the tools.

- A real community – Hundreds of other traders using the same framework, sharing observations, and helping each other improve. You’re not alone in this.

Bottom line: You’re joining a supported community with real education and real people—not buying a software subscription and getting ghosted.

Q: Can I cancel anytime? What if I don't make a profitable trade?

Yes, you can cancel anytime. No long-term commitment.

You get a 14-day free trial with full access to everything—all tools, all education, the entire community.

After the trial, if you continue, you’re on a monthly or annual membership. Cancel whenever you want.

Our refund policy: If you don’t make one profitable trade worth $150 (the cost of membership) using the GammaEdge system within the first month, and you’ve gone through The GammaEdge FastPass (our education course) in its entirety, we’ll give you a full refund after you request to cancel.

NOTE, an annual membership will not be refund after the 30-day refund window).

We’ll just ask you to answer one question—a brief statement on where we missed the mark so we can improve.

Bottom line: We only win if you win. If the tools don’t help you make better trades, you shouldn’t pay for them.

Ready To Trade 0DTE With Clarity Instead Of Chaos?

You’ve seen the framework. You’ve seen the tools. You’ve seen how we help 0DTE and intraday traders gain the edge.

Now the only question is: Are you ready to stop guessing on intraday trades and start trading with real-time market intelligence that shows you when to trade, where to enter, and when to step aside?

Here’s what happens when you join:

- Instant access to all tools—Market Trend Model, Intraday Volume Analysis, Key Levels, NetStat, Web App, Discord Bots, everything

- The GammaEdge FastPass – Full onboarding course that walks you through the framework step-by-step

- Daily pre-market analysis from the GammaEdge team so you start every session with a clear gameplan

- A community of hundreds of traders using the same framework, sharing insights, and improving together

14-day free trial. Cancel anytime.

And if you don’t make one profitable trade worth $150 using the system within your first month (after completing the FastPass), we’ll refund you in full. No questions asked—just tell us where we missed the mark so we can improve.

You’re not risking anything. The only risk is staying where you are—guessing on market character, chasing price action, and getting chopped up on days you should have stepped aside.

Join hundreds of traders already using GammaEdge to build better watchlists, time better entries, and hold winners longer.

We train traders to simplify the options markets with our industry leading data, tools, and education to achieve profitability.

Products

Quick Links

Get In Touch

email: contactus@gammaedge.us