Options Profit Targets: The Complete Guide To Taking Profits

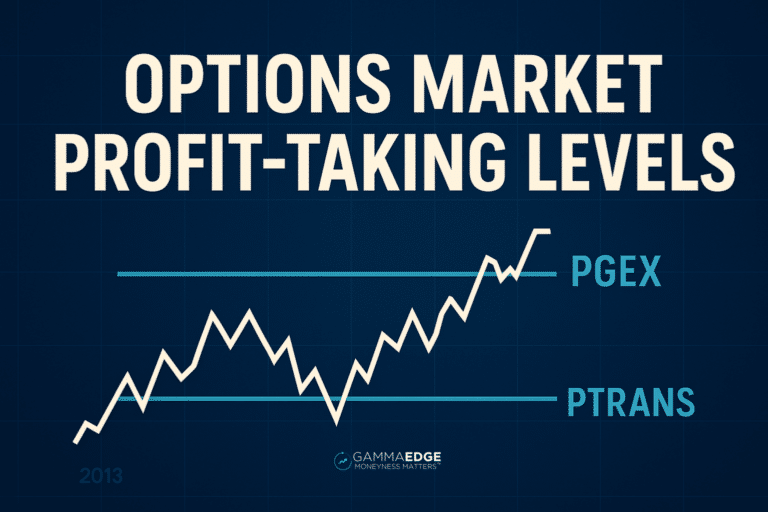

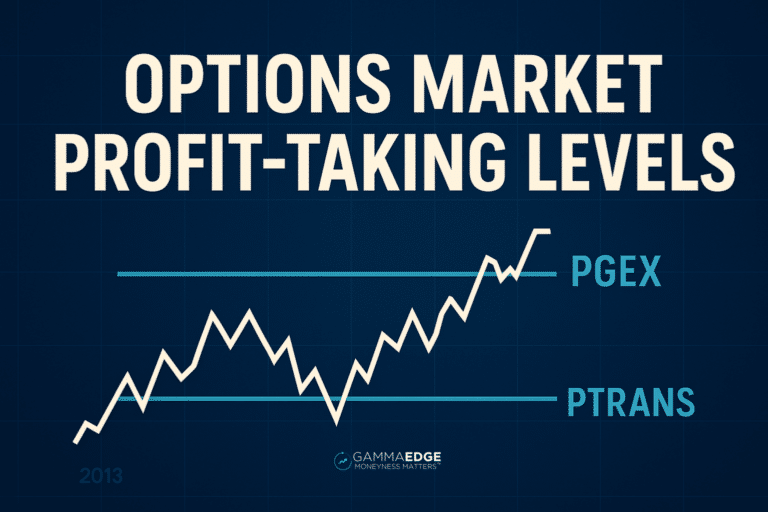

Find options profit targets using market structure. Stop guessing where to exit with +GEX, COI, COTMP, and COTMC levels that reveal hidden profit zones.

Find options profit targets using market structure. Stop guessing where to exit with +GEX, COI, COTMP, and COTMC levels that reveal hidden profit zones.

See potential reversals, validate trend strength, and gain a trading edge with the Gex Ratio — a powerful options sentiment indicator.

Master SPX 0DTE options volume analysis to forecast market direction. Track call and put centroids to reveal trends before price action confirms.

Perform effective market trend analysis using our Market Trend Model. Identify real-time market flows & position yourself based on sentiment.

Have you ever wondered why some market reversals fizzle out while others develop into sustained trends? The answer lies in understanding the different segments of the SPX options market and what they tell us about trader positioning. That’s where separating…

Level up your ability to spot bearish to bullish shifts — and identify market bottoms — by combining momentum analysis & options market structure.

Introduction Have you ever watched markets violently snap back after significant declines, creating those dramatic V-shaped recoveries that seem to come out of nowhere? These explosive market reversals often catch traders off guard, leaving many wondering what just happened. The…

Learn how NetStat reveals hidden market forces through Delta, Gamma, Charm, and Vanna analysis, allowing traders to anticipate price moves before they appear on charts.

Most traders have been taught that making money in the markets requires catching big moves. You’ve probably heard it yourself – “the trend is your friend” or “buy low, sell high.” These mantras aren’t wrong, but they miss an important…

Have you ever traded a stock that appeared bullish on your charts, only to get repeatedly stopped out? You’re likely fighting against deteriorating market structure that isn’t visible on traditional price charts. What if you could spot these warning signs…