Delta Balance In Trading: Your Ultimate Guide To Reading Market Structure Like A Pro

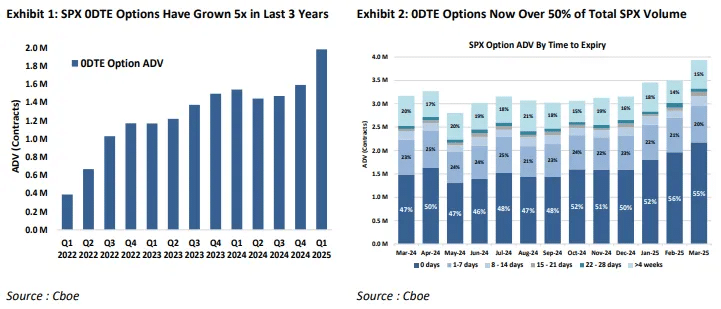

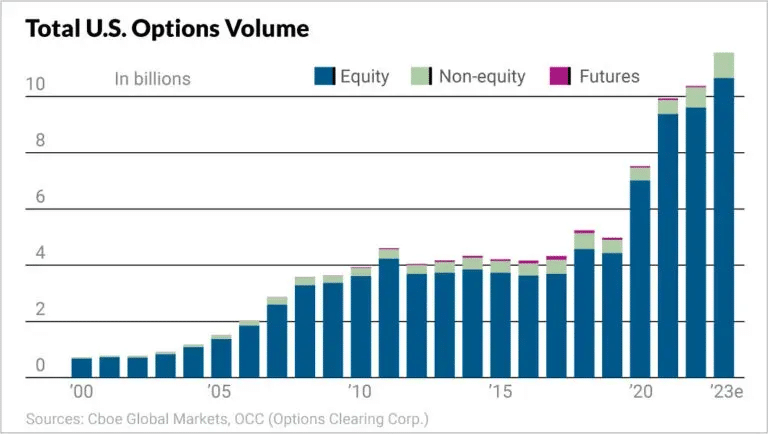

The options market has grown 5x in just the last three years. SPX zero-days-to-expiration (0DTE) options alone now make up over 50% of all SPX options trading, with over $1 trillion in notional value changing hands daily.

This explosive growth means options positioning often drives stock prices rather than the other way around – the tail is now wagging the dog. Understanding how all these participants are positioned has become critical for anyone trading today’s markets.

What makes options markets particularly valuable is that they’re inherently forward-looking. While price charts only show you what has already happened, options reveal where speculators expect prices to be in the future – across various time horizons.

Delta balance in trading represents one of the most powerful tools for understanding this forward-looking market structure. By mastering delta balance analysis, you can see market expectations across different time horizons and position yourself ahead of major moves.

Table of Contents

What is Delta Balance in Trading?

Delta balance in trading is a sophisticated tool that visualizes the ongoing battle between call and put speculators above and below the current market price. Think of it as a real-time map showing where bulls and bears are placing their bets across the entire options structure.

The Delta Balance tool reveals three critical components:

- Market positioning above current price (Right Hand Plane)

- Market positioning below current price (Left Hand Plane)

- Net balance across the entire structure

This forward-looking aspect matters because markets are path-dependent. Today’s positioning influences tomorrow’s price movement, which then shapes the next day’s action. By understanding how speculators are positioned not just now but across different future expirations, you can see the expected “roadmap” from point A to point B to point C.

How Delta Balance Differs from Traditional Technical Analysis

Traditional trading delta balance analysis goes far beyond simple price charts. While conventional technical analysis focuses solely on historical price patterns, delta balance in trading reveals the actual positioning of market participants who are betting on future outcomes.

Here’s the key distinction:

- Price charts: Show you what has already happened

- Delta balance: Shows you what market participants are betting will happen next

Understanding the Delta Balance Visualization

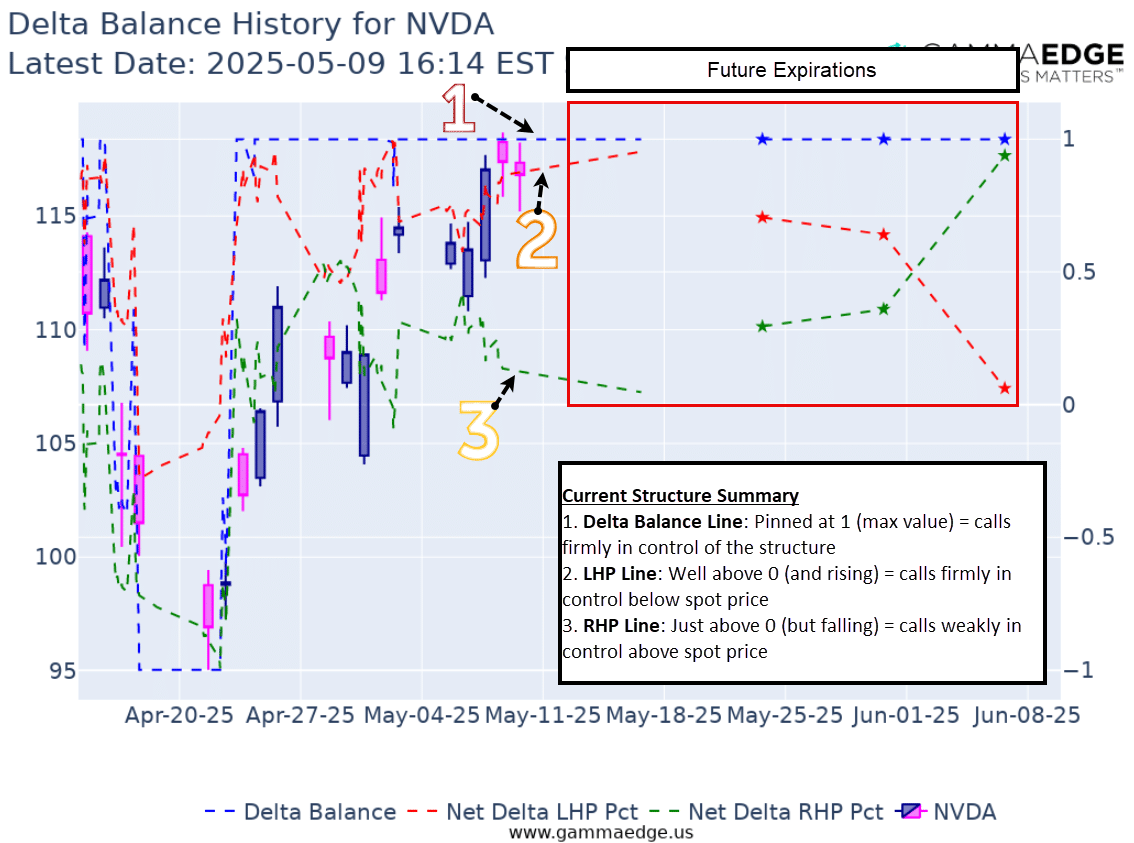

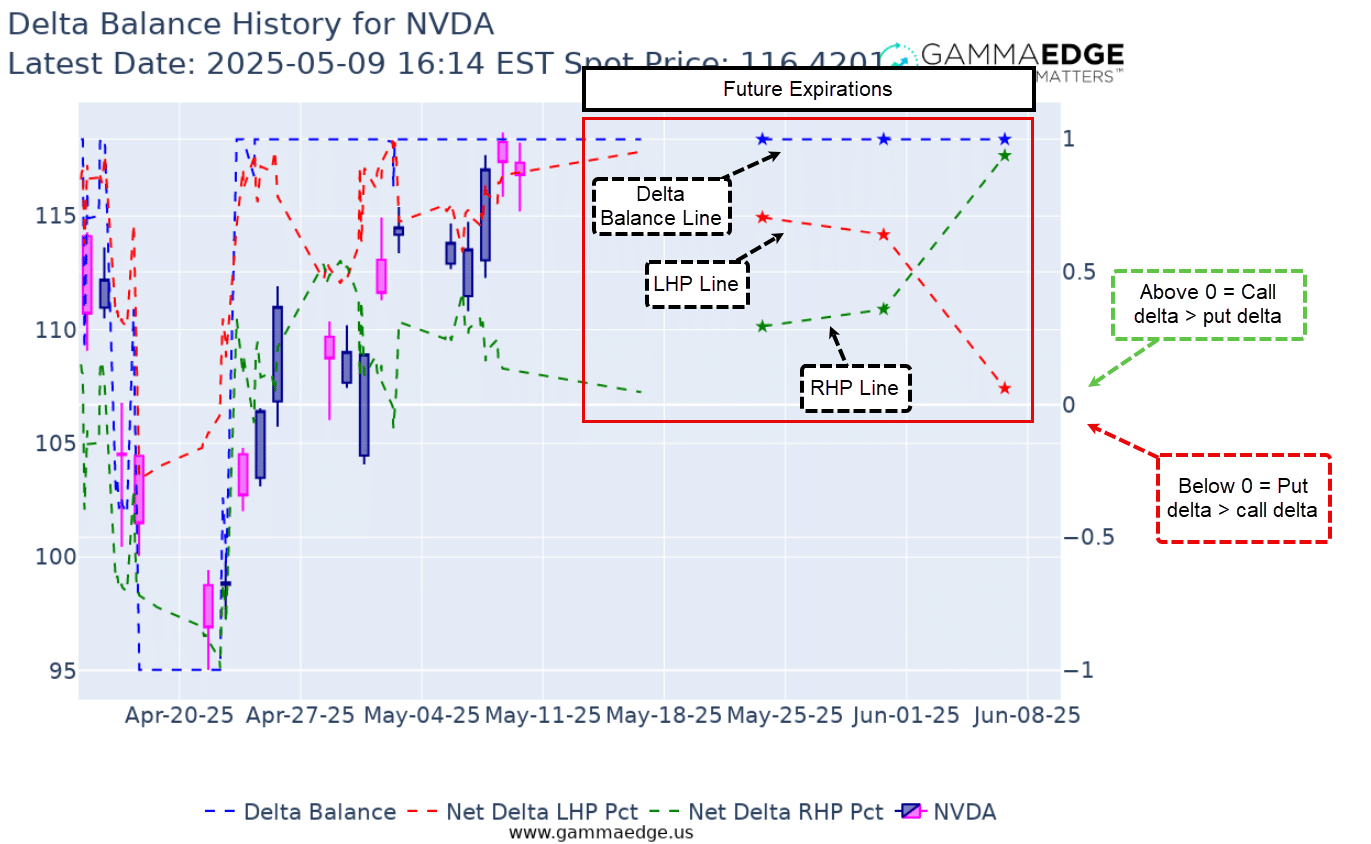

The delta balance chart visualization produces three key trend lines that tell the complete story of market structure:

The Three Essential Lines

- Green Line (Right Hand Plane): Shows who’s winning above spot price

- Above spot price, options can only be OTM Calls or ITM Puts

- Above 0 = Call dominance (bullish above current price)

- Below 0 = Put dominance (bearish above current price)

- Orange Line (Left Hand Plane): Shows who’s winning below spot price

- Below spot price, options can only be OTM Puts or ITM Calls

- Above 0 = Call dominance (bullish below current price)

- Below 0 = Put dominance (bearish below current price)

- Blue Line (Delta Balance): Shows the net balance across the entire structure

- Above 0 = Overall call dominance (net bullish structure)

- Below 0 = Overall put dominance (net bearish structure)

Reading Future Expirations

The red box on the right side of the visualization shows future expirations – your window into the market’s future expectations. When future expirations show a different picture than current positioning, it can be an early warning of a sentiment shift before it appears in price.

Pro Tip: The trend of the delta balance lines often tells a more important story than their absolute values. Rising lines indicate strengthening call positioning (bullish momentum building), while falling lines show increasing put dominance (bearish pressure growing).

Why Delta Balance in Trading Matters for Your Success

Delta balance trading strategies provide three key advantages over traditional analysis:

1. Structural Insight

Reveals whether bullish or bearish positioning is dominant above and below current price, giving you a complete picture of market structure.

2. Early Warning System

Often shows sentiment shifts before they appear in price action, allowing you to position ahead of major moves rather than chasing them.

3. Future Expectations

The plotting of delta balance for future expirations visualizes the future expectations of speculators regarding price appreciation or depreciation.

How to Read Delta Balance Like a Professional Trader

Step 1: Identify Who’s in Control

Right Hand Plane Analysis (Above Spot Price):

- Green line above 0: OTM calls dominate above spot price (bullish structure above)

- Green line below 0: ITM puts dominate above spot price (bearish structure above)

Left Hand Plane Analysis (Below Spot Price):

- Orange line above 0: ITM calls dominate below spot price (bullish structure below)

- Orange line below 0: OTM puts dominate below spot price (bearish structure below)

Overall Delta Balance:

- Blue line above 0: Overall call dominance (net bullish structure)

- Blue line below 0: Overall put dominance (net bearish structure)

Step 2: Recognize Common Market Structures

Bullish Structure in Delta Balance Trading:

- RHP (Green) line above 0 (calls dominant above spot)

- LHP (Orange) line above 0 (calls dominant below spot)

- Delta Balance (Blue) line pinned at or near 1 (maximum call dominance)

Bearish Structure in Delta Balance Trading:

- RHP (Green) line below 0 (puts dominant above spot)

- LHP (Orange) line below 0 (puts dominant below spot)

- Delta Balance (Blue) line pinned at or near -1 (maximum put dominance)

Step 3: Track Structural Evolution

The true value of delta balance analysis in trading comes from watching how structures evolve over time:

Strengthening Bullish Trend:

- RHP (Green) line rising or staying elevated

- LHP (Orange) line rising or staying elevated

- Delta Balance (Blue) line consistently at or near 1

- Future expirations showing similar or stronger call dominance

Deteriorating Bullish Trend:

- RHP (Green) line beginning to decline

- LHP (Orange) line beginning to decline

- Delta Balance (Blue) line moving away from 1

- Future expirations showing weakening call dominance

FAQs & Common Questions About Delta Balance In Trading

How is Delta Balance different from traditional sentiment indicators?

Unlike traditional sentiment tools that simply measure overall put/call ratios, volume, or just things only through a price chart, Delta Balance specifically shows where sentiment is concentrated in the market structure. It reveals not just whether bulls or bears are dominant, but exactly where they’re placing their bets relative to current price – both now and in future expirations.

Can this tool predict exact price targets?

Delta Balance isn’t designed to predict specific price targets. Rather, it shows you the structural forces that influence price movement. Think of it as revealing the path of least resistance rather than an exact destination. When used alongside other GammaEdge tools like the Market Trend Model, it helps you understand the “why” behind price movement.

What time frame works best with Delta Balance analysis?

The Delta Balance tool is particularly valuable for multi-day and multi-week trades – its true power lies in showing structural shifts across different time horizons. Swing traders often find the most value by monitoring changes in future expirations for early signals of trend changes.

How does Delta Balance work with other GammaEdge tools?

Delta Balance works powerfully alongside other GammaEdge tools:

- Use with the GEX Ratio to confirm sentiment trends

- Combine with the Market Trend Model to align with broader momentum

- Use alongside the Web App Dashboard to understand key structural levels

The greatest unlocks often come from finding confluence between these different tools – when they all point in the same direction, your conviction in a trade increases significantly.

In fact, we wrote a specific deep dive on using the Delta Balance tool in tandem with the GEX Ratio, which you can unlock HERE.

Combining Delta Balance with Other Trading Tools

Delta balance trading becomes even more powerful when combined with complementary analysis tools:

Delta Balance + GEX Ratio

- Use GEX Ratio to confirm sentiment trends identified in delta balance

- Look for alignment between rising GEX Ratio and strengthening call dominance

- Learn more about GEX Ratio analysis in our comprehensive guide

Delta Balance + Market Trend Model

- Combine with Market Trend Model to align with broader momentum

- Confirm delta balance signals with actual buying/selling pressure

- Discover how the Market Trend Model enhances your trading

Delta Balance + Transition Zones

- Use alongside transition zone analysis to understand key structural levels

- Identify optimal entry points when delta balance and price structure align

- Master transition zone trading with our detailed tutorial

Conclusion: Mastering Delta Balance in Trading

Delta balance in trading offers a unique window into market structure that price charts alone simply cannot provide. By revealing the positioning of call and put speculators across different timeframes, you gain insight into not just current sentiment, but where the market expects to go next.

What makes delta balance trading particularly powerful is its forward-looking nature. The visualization of future expirations often signals trend changes days or even weeks before they appear in price action – giving you a crucial edge in positioning ahead of major moves rather than chasing them after they’ve begun.

Through this comprehensive guide, you’ve learned how to:

- Interpret the three key trend lines that reveal market structure

- Identify different structural patterns and their trading implications

- Track how positioning evolves to spot strengthening or deteriorating trends

- Use future expirations to anticipate potential reversals or trend changes

- Integrate delta balance with other technical analysis tools

Remember that delta balance in trading is most effective when used as part of your broader analysis framework. When combined with other tools like the GEX Ratio and Market Trend Model, you create a comprehensive view of market conditions that can significantly improve your trading decisions.

Start by monitoring delta balance for major indices and a few key stocks in your watchlist. Pay particular attention to any divergences between current positioning and future expirations, as these often provide the earliest signals of important market turns.

We train traders to simplify the options markets with our industry leading data, tools, and education to achieve profitability.

Services

Quick Links

Get In Touch

email: contactus@gammaedge.us