The Wheel Strategy: Options Trading Complete Guide 2025

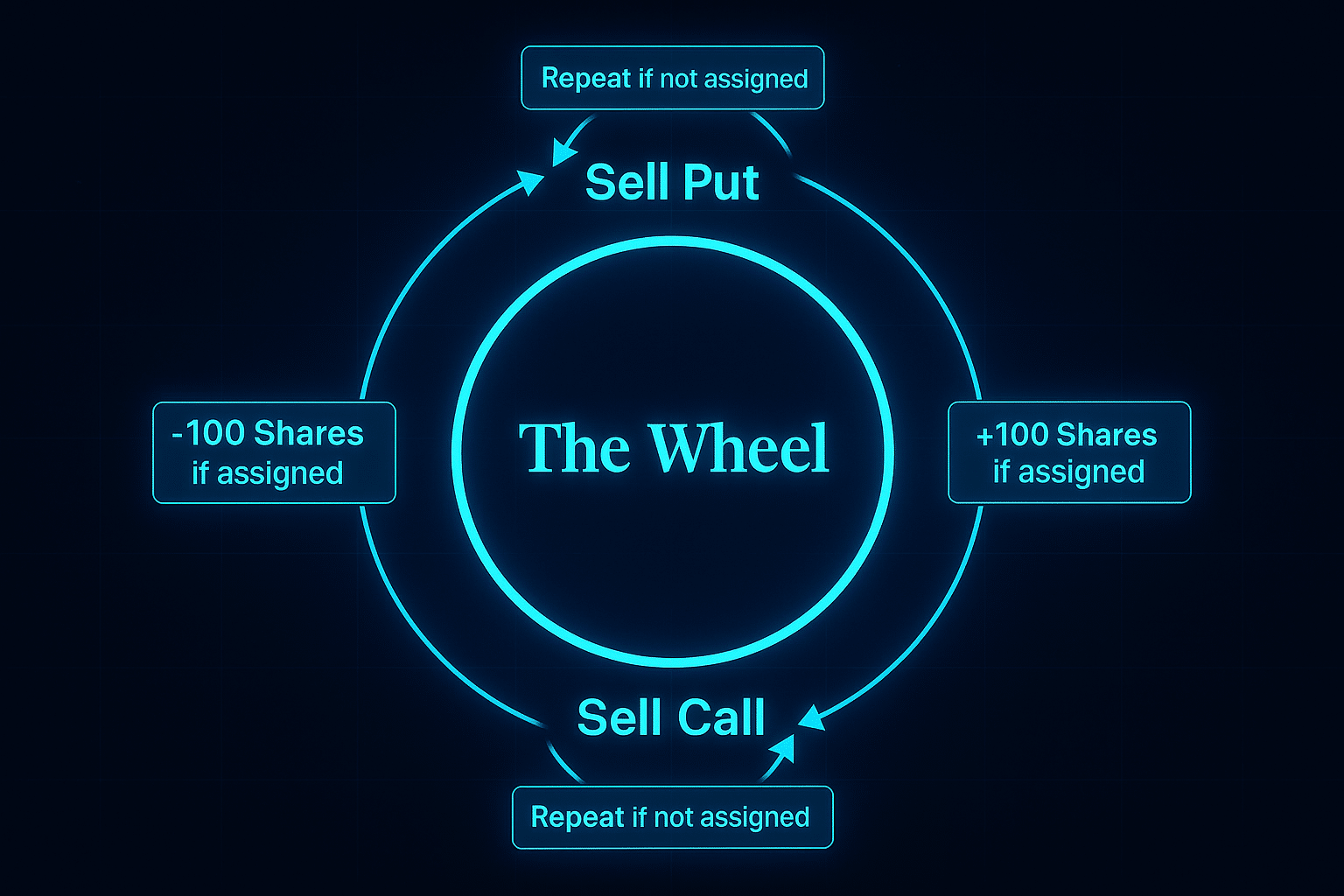

The wheel options strategy is a systematic income-generating approach that involves selling cash-secured puts to acquire stocks at lower prices, potentially, and then selling covered calls on the assigned shares to generate additional income. This cyclical process—selling puts, accepting assignment, selling calls, and repeating—creates a “wheel” of premium collection while building stock positions at favorable prices.

Here’s a scenario you’ve likely encountered (or heard about) before: You sold a cash-secured put last month with a strike price of $50. Sure enough, the stock dropped, and you got assigned at $50; now you’re holding shares with spot price at $45. You sell a covered call at your $50 breakeven point, collect $75 in premium, and wait for the recovery.

Three weeks later, the stock hits $48.

Your call expires worthless.

You sell another call at the $50-strike. Then another for $40.

Six months pass. You’ve collected a total of $200 in premiums, reducing your cost basis to $48. But you’re still stuck underwater in a losing position that’s tying up $5,000 in capital—and the stock shows no signs of breaking out.

This is the hidden cost of traditional wheel strategies—and it plays out repeatedly. What if there was a better way?

Table of Contents

The Wheel Strategy Problem Most Traders Face

Here’s what happened: You picked a stock that looked promising on the chart—maybe it was consolidating nicely, or perhaps you had heard about it on CNBC. You sold a 20-delta put 45 days out because that’s what the internet said to do.

But here’s the problem: That entire approach is based on legacy market dynamics. Today’s markets work differently.

Here’s what’s changed: Options market positioning now DRIVES stock price movement, which means the stocks you select and the strikes you choose aren’t just important—they determine whether you’re trading with market structure or fighting against it.

- When significant speculation (a combination of retail and institutional investors) piles into calls, market makers must hedge by buying stock, creating upward pressure.

- When put buying accelerates, dealers sell stock to hedge—creating downward pressure.

Traditional wheel strategies ignore this entirely.

Your stock passed the basic technical screen. But underneath the surface, options positioning told a different story. That key bit of information may have prevented the stock assignment and valuable capital tied up for an extended period of time.

The Traditional Wheel Strategy & Modern Market

The Traditional Approach Falls Short

Most traders run the wheel by:

- Problem: Fixed delta targeting (0.20) ignores market conditions and stock quality

- Problem: 45-day expirations create extended exposure to changing fundamentals

- Problem: Rolling losing positions converts small losses into large ones

- Problem: Arbitrary stock selection lacks institutional positioning insights

The GammaEdge Advantage: Instead of trading blind, our framework provides:

- Solution: Dynamic stock selection based on actual institutional activity

- Solution: Short duration (1-2 weeks) limits time for adverse developments

- Solution: Clean assignment acceptance on quality stocks rather than hope-based rolling

- Solution: Multiple confirmation layers before any position initiation

The result?

- Higher win rates

- Superior profit factors, and

- Lower assignment rates

And all of this is systematically identified for you through GammaEdge’s framework, which, as you will see by the end of this article, is superior to hoping market conditions remain favorable.

Let’s start by understanding how the traditional wheel actually works—then we’ll reveal exactly how GammaEdge transforms each step from guesswork into measurable, systematic edge.

um dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

How The Traditional Wheel Strategy Works

The wheel strategy derives its name from its cyclical nature—much like a wheel that keeps turning, the process repeats indefinitely. Here’s how each phase works:

Phase 1: Sell a Cash-Secured Put

You start by selling a put option on a stock you wouldn’t mind owning. When you sell this put, you’re agreeing to buy 100 shares at a specific price (the strike price) if the stock falls to that level (or lower) by expiration.

- What “cash-secured” means: You must have enough cash in your account to purchase 100 shares at the strike price (offset by the premium that you will receive, but we’ll ignore that for now). If you sell a $50 put, you need $5,000 in cash reserves. This isn’t margin or leverage—it’s fully backed by cash.

- What you receive: Immediate premium income that’s yours to keep regardless of what happens next. If you sell a $50 put and collect $0.75 ($75 per contract), that money hits your account instantly.

Phase 2: Two Possible Outcomes

Outcome A: Put Expires Worthless (Stock Stays Above Strike)

- The stock stays above $50 into expiration

- Your put expires worthless, and you keep the entire premium

- You’re free to start the wheel again by selling another put

Outcome B: Assignment (Stock Drops Below Strike)

- The stock falls to or below $50

- You’re assigned 100 shares at $50 per share

- Your $5,000 cash is now converted to 100 shares of stock

- You still keep the original premium you collected (reducing your basis)

Phase 3: Sell a Covered Call (If Assigned)

Once you own the shares, you enter the second leg of the wheel—selling covered calls.

- How it works: You sell a call option on the 100 shares you now own. This call gives the buyer the right to purchase your shares at a specific strike price by the expiration date.

- Strike selection: Most traders sell calls at or above their assignment price to create a breakeven or profitable exit. If you were assigned at $50, you might sell a $50 or $52 call.

What you receive: Another premium payment for selling the call. This premium further reduces your effective cost basis on the shares (the premium from the sold put plus the premium from the sold call).

Phase 4: The Wheel Completes (Or Continues)

Scenario A: Shares Get Called Away (Stock Rises Above Strike)

- Stock rises above your call strike ($50+)

- Your shares are sold at the strike price

- You keep all premiums collected from selling both the put and the call

- The wheel cycle completes—you can start fresh with a new put

Scenario B: Call Expires Worthless (Stock Stays Below Strike)

- Stock stays below $50

- You keep your shares and the call premium

- You can sell another covered call

- This continues until shares are eventually called away

Why Traders Love the Traditional Approach

The wheel’s appeal is straightforward:

- Income Generation: Collect premiums at every step—from selling puts, from selling calls, and potentially from both multiple times before shares are called away.

- “Buying the Dip”: When assigned, you’re acquiring shares at prices below where the stock was trading when you sold the put—essentially buying at a discount.

- Defined Risk: Your maximum loss is limited to owning the stock at your strike price minus all premiums collected. Unlike naked options, there’s no unlimited risk.

- Simplicity: The mechanical process is straightforward—sell puts, accept assignment if it happens, sell calls, repeat.

But here’s what traditional wheel guides won’t tell you: The stocks you choose and when you choose them determine everything. Two traders running the same wheel mechanics can achieve completely different results, based solely on the stocks they select and the underlying options market structure when they enter.

That’s where most wheel strategies break down—and where GammaEdge’s framework creates systematic edge.

Let’s examine what traditional approaches are lacking in today’s markets.

Three Market Forces Most Wheel Traders Are Trading Without

Traditional wheel strategies operate on a simple premise: sell premium, own good stocks, repeat. However, this approach was designed for markets that have undergone fundamental changes.

Your stock selection and timing aren’t just important—they determine whether you’re trading with these structural forces or fighting against them. Let’s break down the three forces traditional wheel strategies ignore entirely:

Force #1: Institutional Positioning (Who's Actually Behind the Move?)

- What Traditional Analysis Shows: Price patterns, moving averages, and volume—the visible footprints of market movement.

- What’s Missing: Traditional charts can’t reveal who is driving those moves or whether institutional money is still positioned in your direction. You might sell puts on a consolidating stock without knowing that large call buyers are actually exiting positions underneath.

- The GammaEdge Solution: Our proprietary scanners ($allcalldom, $ncalldomdel, $ncalldomcha, $newrhpbulldb) reveal exactly where institutional and retail speculation is concentrating. When you see heavy call positioning expanding, you’re not guessing about bullish intent—you’re seeing the actual money flows that force dealer hedging in your favor.

Practical Application: Instead of selling puts on any stock with a decent technical setup, you target stocks where GammaEdge scanners show a call-dominated structure with expanding delta. You’re aligning with significant bullish options activity, not hoping it materializes.

Force #2: Market Structure Timing (When Should You Actually Enter?)

- What Traditional Analysis Shows: Stock charts, technical setups, and individual company fundamentals—the signals that suggest a stock is ready for a move.

- What’s Missing: Traditional timing focuses solely on individual stocks, ignoring macro conditions that can overwhelm even the best stock selection. You might be selling puts on a perfectly qualified stock during a period when the broader market structure is deteriorating—put-dominated with declining dealer support. Even great stocks get pulled down in these environments, leading to unnecessary assignments and capital tie-ups.

- The GammaEdge Solution: Our Market Trend Model (MTM) acts as a master gate for new entries. This proprietary momentum tool analyzes underlying market momentum through the TICK Index and broader structure. Specifically, when our TC3+ signal (a measurement of multi-week bullish momentum) is “False”, we don’t initiate new positions—regardless of how attractive individual setups appear.

- Practical Application: Rather than fighting deteriorating market conditions, you only sell new puts when our TC3+ momentum signal confirms a favorable macro structure. This single filter has been shown to significantly reduce drawdowns by preventing entries during unfavorable environments.

We’d rather be looking for entries during environments like this, when TC3+ is turned on, which is when the Cyan and Red moving averages are trending higher (as shown in the image below)….

…rather than environments that look like this, when TC3+ is turned off, indicating to us that markets are weak/weakening:

Force #3: Stock Quality Mechanics (Casual Analysis vs. Systematic Momentum)

- What Traditional Analysis Shows: Basic technical filters like “stock above its 50-day moving average” or “consolidating near highs” – are binary checks that suggest a stock has momentum.

- What’s Missing: These simple screens miss the deeper momentum quality that determines whether an assigned stock will recover efficiently. Your stock might pass basic technical filters while failing on critical momentum relationships: a 50-day MA below the 150-day MA, a 200-day slope turning negative, or positioning outside the top 25% of its 52-week range. These deteriorating conditions increase assignment risk and extend recovery time when you do get assigned.

- GammaEdge Solution: We combine GammaEdge structure analysis (i.e., call-dominated) with Mark Minervini’s trend template (inclusive of 8-factors), which is a proven technical momentum system. This dual filter ensures you’re only selling puts on stocks showing both bullish options positioning and technical momentum quality. This isn’t a subjective chart interpretation—it’s a weighted, mathematical assessment created by GammaEdge and based on Minervini’s criteria of institutional-quality momentum.

- The Minervini scoring system evaluates:

- Moving average relationships (50d > 150d > 200d)

- Trend slope and momentum

- Distance from 52-week highs and 52-week lows

- Relative strength characteristics

Practical Application: Before selling any put, you verify both the GammaEdge scanner appearance AND a high Minervini score. This means assignments occur only on high-quality stocks where recovery is statistically probable—not hope-based holdings.

The Compounding Effect

Understanding each force individually is valuable, but what makes this framework powerful is that these three forces stack the edges in your favor.

When you sell puts on stocks showing:

- Bullish institutional & retail options positioning (Force #1)

- During favorable macro conditions (Force #2)

- With proven technical momentum quality (Force #3)

You’re not just improving your odds incrementally—you’re creating a multi-layered statistical edge where each filter compounds the effects of the others. This is why GammaEdge Wheel traders achieve a win rate of over 80%, higher net gains, and lower intra-trade drawdown. At the same time, traditional approaches tend to yield variable results with lower net gains, deeper intra-trade drawdown, and significantly higher assignment rates.

The difference isn’t luck or market timing. It provides visibility into forces that drive outcomes but remain invisible to traditional analysis.

The GammaEdge Wheel Framework: From Hope to Structure

Traditional wheel strategies leave you guessing. The GammaEdge Wheel Strategy eliminates guesswork through a three-phase systematic approach that aligns every decision with measurable market structure.

Here’s how it works:

Phase 1: Cash-Secured Put Selection (Entry with Edge)

Unlike traditional approaches that sell puts on any decent-looking stock, GammaEdge uses multi-layer filtering to identify only the highest-probability opportunities.

And don’t worry—we’ll show you how GammaEdge automates this entire qualification process in just a moment.

The Three-Gate Qualification System:

Gate 1: Market Timing (TC3+ Bullish Signal)

- Only initiate new CSP positions when the TC3+ Market Trend Model is “True” or “On”

- This proprietary signal analyzes underlying market momentum through the TICK Index

- Prevents entries during unfavorable macro conditions that can overwhelm individual stock selection

- Exception: Basis reduction CSPs after assignment ignore TC3+ (covered in Phase 2 below)

Gate 2: Institutional Positioning (GammaEdge Scanners)

- Stock must appear on current GammaEdge bullish structure scanners:

- $allcalldom (call-dominated structure)

- $ncalldomdel (new call dominance via delta)

- $ncalldomcha (new call dominance via charm)

- $newrhpbulldb (new bullish OTM call speculation)

By showing up on one of these four scans, these stocks are displaying the following bullish characteristics:

- OTM call delta expansion, preferably with simultaneous OTM put delta contraction

- Active bullish positioning via institutional and retail participation

Gate 3: Technical Momentum (High Minervini Scoring)

- Calculate the systematic 8-factor momentum score

- Ensures only institutional-quality momentum stocks pass through

- High-weighted factors: 150d MA > 200d MA, positive 200d slope, 50d MA > 150d MA

- Result: You only sell puts on stocks where assignment would mean owning genuine quality

Strike Selection Strategy:

Once a stock qualifies, target strikes with:

- >68% probability of expiring OTM (often >80% in practice)

- Minimum 1% ROO (Return on Option: Premium / Strike Price)

- Minimum 15% AROO (Annualized ROO: ROO × 365 / Days to Expiration)

- 1-2 weeks to expiration maximum (shorter duration limits exposure to changing conditions and facilitates capital turnover, which increases net gains in the strategy)

The GammaEdge Advantage: Traditional approaches use 30-45 day expirations at fixed deltas. We use a 1-2 week duration on systematically qualified stocks. This results in faster capital turnover and reduced exposure to deteriorating fundamentals.

Critical Insight: If you’re thinking “this sounds like a lot of work to screen every stock,” here’s the relief: All of this analysis is automatically done for you through GammaEdge’s suite of scanners. Every day, our system processes hundreds of optionable stocks through these exact filters—TC3+ signal, options market positioning, Minervini scoring—and delivers only the qualified opportunities directly to you. What would take hours of manual analysis per stock happens instantly. You focus on execution; we handle the systematic edge identification.

Position Management:

- Immediately upon CSP execution, place a Good-Til-Canceled (GTC) Buy-to-Close (BTC) order at 10% of the premium received (rounded up to the nearest $0.05)

- Automatic profit-taking captures optimal theta decay

- No discretionary holding, no hoping for maximum profit

Phase 2: Assignment Management (Systematic Response, Not Hope)

Here’s where traditional wheels break down—and where GammaEdge creates separation.

- Traditional Approach: Roll the losing put indefinitely, hoping for recovery. This converts small losses into large ones and creates “boat anchor” positions that drag down returns.

- GammaEdge Method: Accept assignment on quality stocks, then follow systematic protocols.

- Immediate Assignment Response: Upon assignment, evaluate the covered call opportunity:

- If Premium Available (≥$0.10 after commissions at assignment strike, higher is the goal):

- Immediately sell a covered call at the assignment strike price

- Creates a breakeven exit when shares are called away

- Use the same short-duration approach (1-2 weeks)

- If No Adequate Premium Available:

- Hold assigned shares

- Initiate basis reduction strategy using additional CSPs

- If Premium Available (≥$0.10 after commissions at assignment strike, higher is the goal):

Basis Reduction Strategy:

Instead of hoping that the stock recovers, actively reduce your cost basis:

- Capital Reallocation: Prioritize assigned position over new opportunities

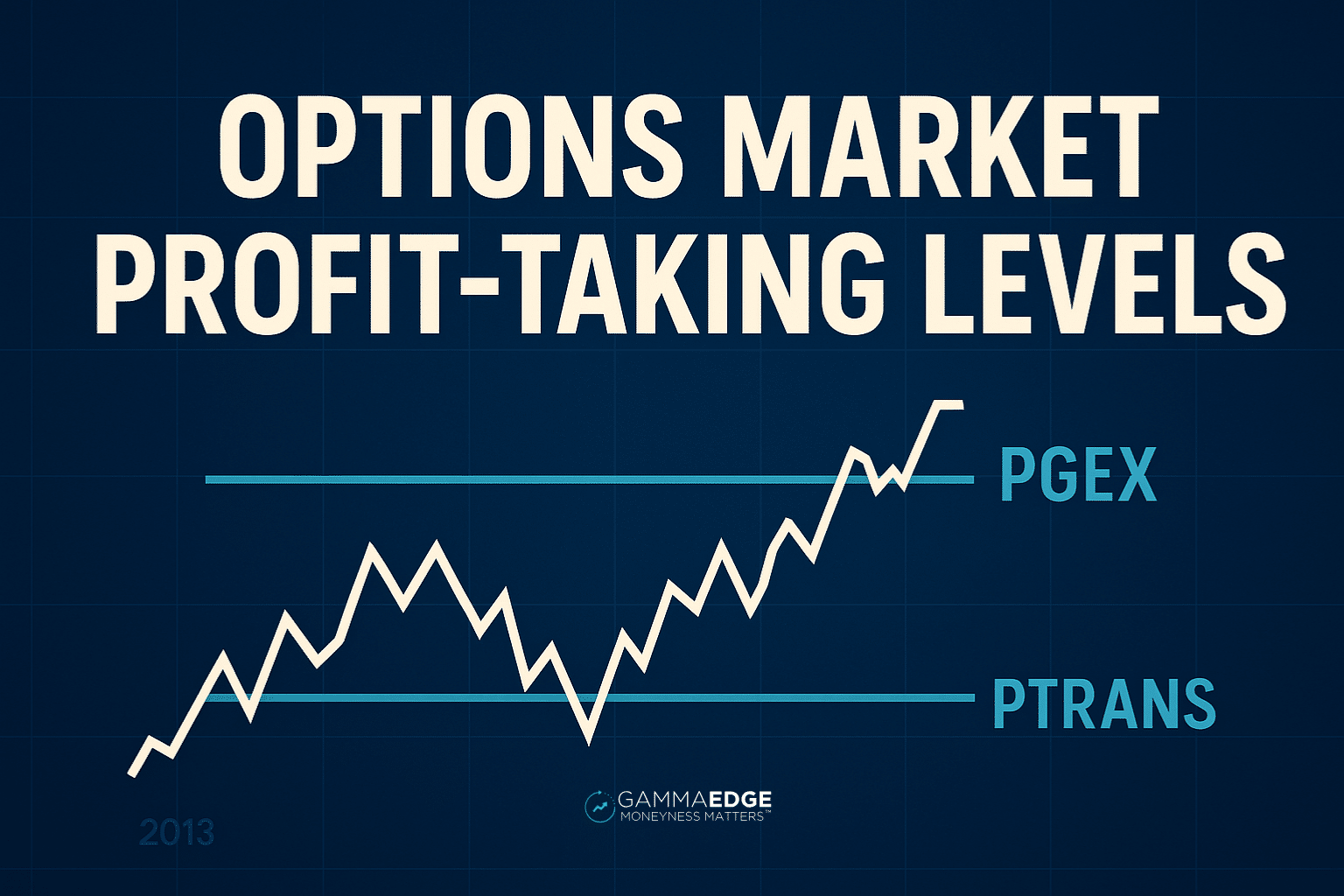

- Strike Selection: Use GammaEdge’s proprietary -Trans (transition zone) or –GEX levels for the stock. These represent areas where a put-dominated structure exists and dealer selling pressure naturally concentrates, creating natural support zones for additional put options to be sold.

- Execution: Sell additional CSPs at these structural levels with the same 10% BTC exit rule

- Iteration: If assigned again, repeat the process with the new average cost basis

GammaEdge Advantage: Traditional traders pick arbitrary lower strikes and hope. We target specific structural levels where options positioning reveals natural support zones. Basis reduction becomes systematic rather than random.

Critical Note: Basis reduction CSPs ignore TC3+ signal requirements—you’re managing an existing position, not initiating new risk.

Phase 3: Call-Away Management (Completing the Cycle)

Covered Call Execution:

- Sell calls at or above average cost basis (ensuring breakeven or profitable exit)

- Target minimum $0.10 premium after commissions

- Maintain a short-duration approach (1-2 weeks)

- Accept assignment on covered calls—clean exit returns capital to new opportunities

The Wheel Completes:

- Shares called away at breakeven or profit

- All premiums collected (original put + any basis reduction puts + covered calls)

- Capital freed for the next high-probability setup meeting all three qualification gates

Why This Framework Creates Systematic Edge

Traditional Wheel Reality:

- Variable win rate (even with discipline)

- More frequent assignments requiring hope-based management

- Capital is tied up for months in deteriorating positions

- Inconsistent results driven by luck and timing

GammaEdge Wheel Performance:

- 80% win rate through multi-layer filtering

- <10% assignment rate due to high-probability strike selection

- Systematic assignment management eliminates “boat anchor” positions

- Profit factor >2.5 through structural alignment

The Key Insight: Every decision—from stock selection to strike choice to assignment management—is driven by observable market structure rather than hope, gut feeling, or arbitrary rules.

You’re not running a wheel strategy. You’re executing a systematic framework where institutional positioning, technical momentum, and macro timing align in your favor.

Advanced Application: Optimizing Your GammaEdge Wheel Execution

You understand the framework. GammaEdge delivers the qualified opportunities. Now let’s focus on execution refinements that separate good results from exceptional ones.

Position Sizing Through Expectancy Management

Traditional wheel strategies use arbitrary position sizing—”I’ll sell 5 contracts because I have $25K” or “one contract per opportunity.” GammaEdge uses expectancy-driven sizing (based on your performance) that creates a self-improving feedback loop.

How It Works:

- After each closed trade, calculate your running expectancy (average P&L per trade)

- New Expectancy = ((Previous Expectancy × Trade Count) + Current Trade P&L) / (Trade Count + 1)

- The Rule: Each new trade must generate a premium ≥ current expectancy.

Practical Example: If your average profit is $85 per trade (running expectancy), then $85 is your minimum acceptable premium.

- If one contract only pays $45, you must sell 2 contracts (total premium $90) to meet the standard.

- If one contract on a different, higher-priced stock already pays $100, you only sell 1 contract.

Here is another simple three-trade example:

The system tells you how big to go, not the amount of available capital or your gut feeling.

Why This Creates Edge:

- The system naturally becomes more selective as your expectancy rises

- Position sizing scales to meet expectancy, not arbitrary capital deployment

- Prevents “forced trading” during poor market conditions

- Rising standards typically correlate with better risk-adjusted returns

Portfolio Management and Diversification

Here’s a reality check: You don’t need to be fully deployed to be successful with this strategy.

Traditional wheel traders feel pressure to keep all their capital working, which leads to forcing trades on mediocre setups. The GammaEdge approach flips this thinking—your edge comes from selectivity, not activity.

- Build positions gradually. Target around 7 positions when capital and opportunities align, but don’t force it. Smaller accounts might run 3-4 positions during the capital building phase. That’s fine. What matters is that every position meets all three qualification gates.

- Watch your correlation. If you’re holding 5 tech stocks simultaneously, you’re not diversified—you’re concentrated. When scanner activity clusters in one sector, that’s helpful information about where institutional money is flowing. Just be aware of the correlation risk you’re taking on.

The key insight? Quality opportunities come in waves. Some weeks, you’ll find 10 qualified setups. Other weeks you’ll find zero. The system isn’t broken during dry spells—it’s protecting you from suboptimal trades.

Execution Refinements That Matter

- Timing your orders: Many experienced traders place their orders after market close. Why? You can analyze calmly without watching prices fluctuate, and the spread criteria relax to <$0.39 (vs <$0.05 during market hours). Your GTC orders are placed overnight and capture fills during the next trading session, up to option expiry. Less stress, same results.

- Strike selection when multiple options qualify: You’ll often find 2-3 strikes that meet all your criteria—minimum ROO, minimum AROO, high OTM probability. When this happens, bias toward the higher probability strike (>80% OTM) rather than chasing an extra $10 in premium. Remember, assignments are reduced in this system, but they’re even rarer when you prioritize probability.

- The earnings calendar consideration: Your 1-2 week duration naturally avoids most earnings announcements, but it’s worth a quick check. Some traders avoid positions spanning earnings entirely. Others are comfortable with it, given the short timeframe. Know your preference and stick with it.

- Exit discipline: That 10% BTC order handles exits automatically. You’ll be tempted to override it when you’re up 80% with two days left—”why not squeeze out the last 20%?” Resist. The system works because it captures optimal theta decay before late-cycle reversals. Trust the automation.

Understanding Scanner Behavior (This Confuses Everyone at First)

Here’s something that trips up new traders: You sell a put on Tuesday because the stock appeared on scanners. Wednesday morning, you check—and it’s no longer in the scanner results. Did something break? Should you exit?

Neither. This is entirely normal.

The $ncalldomdel, $ncalldomcha, and $newrhpbulldb scanners we use show NEW dominance changes. They’re designed to catch institutional activity as it’s building, which usually means they only flag stocks for a single day. The $allcalldom scanner might show stocks for days or weeks, but even that will cycle.

- What matters: The stock qualified when you entered. The structure was there. Once you’re positioned, falling off scanner lists is irrelevant—just follow your established management rules. The 10% BTC order will automatically handle profitable exits regardless of the scanner status.

- The only real red flag? If you realize you entered a position on a stock that never actually appeared on the scanners. That’s a system violation worth examining in your selection discipline.

Tracking Performance (Without Obsessing)

You need to monitor specific metrics, but don’t turn this into a full-time data analysis job.

- Weekly check-ins should cover: Updated expectancy calculations, any assigned positions needing covered call evaluation, basis reduction progress if you have open assignments, and a quick correlation scan across active positions.

- Monthly deep dives include: Win rate and profit factor trends (aiming for >80% and >2.5, respectively), assignment frequency patterns, average days to exit, and capital utilization rates. You’re looking for patterns, not perfection.

The goal isn’t to micromanage every trade. It’s to spot when your execution might be drifting from the systematic approach. If your win rate drops to 70%, that’s information. Are you compromising on qualification criteria? Getting impatient during opportunity droughts? The metrics tell the story.

When Things Don’t Go According to Plan

Assignments happen. Even with >80% OTM probability trades, you’ll eventually get assigned. Remember what this means: You now own a stock that scored very high on the Minervini’s momentum criteria. That’s institutional-quality positioning. The stock didn’t suddenly become garbage—it’s just temporarily below your strike.

Follow the basis reduction protocols systematically. Use the -Trans and -GEX levels from GammaEdge (available through Discord commands or the WebApp) to target your next CSP strikes. These aren’t arbitrary lower prices—they’re structural support zones where options positioning reveals natural dealer pressure. Be patient. Quality stocks recover; poor stocks languish. This is why the qualification gates matter.

Multiple simultaneous assignments are rare (remember that the <10% assignment rate), but if it happens, you’ve got a clear playbook. Prioritize basis reduction over hunting new opportunities. Redirect available capital toward assignment management. The system handles this scenario—you just need to execute the protocols without panic.

Extended droughts without qualified opportunities actually demonstrate the system working correctly. When market structure deteriorates, fewer stocks will pass through all three gates. This is selectivity protecting your capital, not the strategy failing. Keep uninvested funds in high-yield savings and stay patient. Opportunity clusters return when structure shifts—and you’ll be ready with fresh capital and clear protocols.

The Compounding Effect of Systematic Discipline

Here’s what happens over time with this approach: Your expectancy rises as you execute quality trades. Rising expectancy makes your standards more stringent. Stricter standards mean you only take the strongest setups. Stronger setups produce better outcomes. Better outcomes raise your expectancy further.

It’s a self-reinforcing cycle where success literally raises the bar for future trades. You’re not working harder—you’re letting the systematic edge compound through disciplined execution.

Traditional wheel traders grind through dozens of mediocre trades, hoping for consistency. GammaEdge Wheel traders wait for qualified setups where multiple structural advantages align, then execute with precision—same time investment, dramatically different results.

Frequently Asked Wheel Strategy Questions

Q: Do I need to manually calculate Minervini scores for every stock?

No. GammaEdge scanners automatically filter for stocks meeting the necessary Minervini momentum criteria (along with options market positioning assessment). You receive pre-qualified opportunities—the systematic analysis is already done.

Q: What broker requirements do I need?

You’ll need options trading approval (Level 2 minimum) with the ability to trade cash-secured puts and covered calls. Your broker must support Good-Til-Canceled (GTC) orders for the automated 10% exit strategy. Most major brokers (TD Ameritrade, Interactive Brokers, E*TRADE, TastyTrade, etc.) meet these requirements.

Q: What's the minimum capital needed to run this strategy?

There’s no fixed minimum, but consider that each CSP requires capital equal to 100 shares at the strike price. A $50 strike requires $5,000 in cash-secured capital. The strategy works with single contracts, so smaller accounts can participate. Target 7+ positions for proper diversification when capital allows, but you can start with fewer positions while building.

Q: How much time does this require daily?

Expect 10-20 minutes daily during market hours or after close. Check TC3+ signal status, review GammaEdge scanner results for qualified opportunities, execute any new positions, and monitor existing positions. Weekly reviews add another 20-30 minutes for expectancy updates and assignment management checks.

Q: Is this strategy suitable for retirement accounts?

Yes, CSPs and covered calls are generally allowed in retirement accounts. Check with your broker for specific requirements and restrictions.

Q: Why 1-2 weeks to expiration instead of the traditional 30-45 days?

Shorter duration creates three advantages:

- Faster capital turnover (more opportunities per year)

- Less exposure to changing fundamentals or deteriorating structure, and

- Reduced time for market conditions to shift against your position

The high-probability strike selection (>68% OTM) works even better with compressed timeframes.

Q: What happens if the TC3+ momentum signal turns "False" while I'm holding positions?

Continue managing existing positions according to standard protocols, including 10% BTC orders, assignment management, and basis reduction as needed. TC3+ only gates NEW position entries, not the management of positions you’ve already entered. This prevents adding to risk during unfavorable conditions while letting existing high-probability trades play out.

Q: The stock I entered appeared on scanners yesterday but disappeared today. What do I do?

Nothing. This is entirely normal. The $ncalldomdel, $ncalldomcha, and $newrhpbulldb scanners show NEW dominance changes and typically persist for only one day. Once you’ve qualified a stock and entered a position, scanner status changes are irrelevant. Follow your established management protocols—the 10% BTC exit will automatically handle profitable closes.

Yes, CSPs and covered calls are generally allowed in retirement accounts. Check with your broker for specific requirements and restrictions.

Q: How do I know where to place basis reduction CSPs?

Use GammaEdge’s proprietary -Trans (transition zone) or -GEX levels for the specific stock. Access these through Discord commands (like $s aapl) or the GammaEdge WebApp. These levels represent areas where put-dominated structure exists and dealer selling pressure naturally concentrates—making them optimal support zones for additional put selling.

Q: Should I ever roll a losing CSP position?

Never. The GammaEdge Wheel accepts assignment on quality stocks rather than rolling. Rolling converts small losses into large “boat anchor” positions that drag down returns. Accept the assignment, then use systematic basis reduction protocols to manage the position efficiently.

Q: What's my maximum loss on a single trade?

On individual CSPs, the maximum loss is the full cash-secured amount (strike price × 100 shares) minus collected premiums. However, risk is managed through high-quality stock selection, high probability trades (>68% OTM), short duration (1-2 weeks), and systematic assignment management. Assignments are rare (<10% rate) when proper selection criteria are followed.

Q: What kind of returns should I expect?

Focus on process metrics rather than return targets:

- >80% win rate

- >2.5 profit factor

- <10% assignment rate

When you execute the systematic framework correctly, consistent returns naturally follow from these statistical advantages

Q: Why is the assignment rate so low compared to traditional wheel strategies?

Three factors compound:

- High OTM probability targeting (>68%, often >80%)

- Short duration that limits time for adverse moves, and

- Multi-layer qualification ensures you only sell puts on stocks with both institutional positioning and technical momentum.

Traditional

Q: What if I can't find any qualified opportunities for weeks?

This is normal and healthy. The strategy prioritizes quality over quantity. During periods when market structure deteriorates (TC3+ “False”) or fewer stocks meet all criteria, opportunity flow naturally decreases. Keep uninvested capital in high-yield savings accounts earning 4-5% while waiting. Never compromise qualification gates just to deploy capital. Opportunity clusters return when structure improves.

Q: Can I run this alongside other trading strategies?

Yes, but only if each strategy has demonstrated positive expectancy independently. Multi-strategy approaches can improve capital utilization and smooth equity curves when strategies are complementary. However, mixing unprofitable approaches will dilute the GammaEdge Wheel’s systematic edge. Utilize professional trade logging software to track the performance of individual strategies and ensure optimal capital allocation.

Q: How does expectancy-driven position sizing work in practice?

After each closed trade, update your running expectancy: ((Previous Expectancy × Trade Count) + Current P&L) / (Trade Count + 1). Each new trade must generate a premium ≥ current expectancy. As your expectancy rises, you may need multiple contracts to meet the threshold, or you may find fewer qualified opportunities. This creates a self-improving feedback loop where rising standards naturally filter out marginal setups.

Q: What if market conditions change dramatically?

The strategy adapts naturally:

- Fewer stocks will meet Minervini’s criteria during downturns

- GammaEdge scanners reflect changing institutional structure

- Short duration limits exposure to rapid sentiment shifts

- Quality standards prevent trading in deteriorating conditions

The Bottom Line: From Guessing to Systematic Edge

The wheel strategy isn’t broken—it’s just evolved. Today’s markets demand visibility into forces that traditional analysis can’t provide.

Traditional approaches were designed for markets where price drove options positioning. Today’s markets work differently—options positioning drives price. Yet traditional wheel strategies ignore this fundamental shift entirely.

The GammaEdge Wheel eliminates hope from the equation.

- You’re not guessing which stocks might work—you’re seeing exactly where institutional money is positioning through options market structure.

- You’re not hoping macro conditions cooperate—TC3+ tells you when to engage and when to stand aside.

- You’re not stuck with poor-quality assignments—Minervini scoring ensures every potential assignment is on institutional-grade momentum stocks.

Three gates create compound probability advantages:

- TC3+ Signal for Market Timing filters out unfavorable macro environments

- GammaEdge Structure Analysis reveals institutional positioning through the scanner suite

- Minervini Momentum Scoring ensures only quality stocks pass through

When all three align, you’re not operating on hope—you’re operating on structural alignment.

You’re not just improving your odds incrementally. You’re stacking multiple structural edges, where each layer compounds the effects of the others.

This is why GammaEdge Wheel traders achieve win rates of over 80%, while traditional approaches struggle with subpar results.

The difference isn’t luck. It’s visibility into forces that determine outcomes but remain invisible to traditional analysis.

Every decision in this framework—stock selection, strike choice, entry timing, assignment management—flows from observable market structure rather than hope, gut feeling, or outdated rules designed for different market dynamics.

You’re not running a wheel strategy. You’re executing a systematic approach where institutional positioning, technical momentum, and macro timing align in your favor before you risk a single dollar.

Your Next Steps: Implementation Path

This week’s action items:

- Get systematic education: The concepts in this article provide the foundation!

- Access the tools: You can find the scan results daily within the dedicated Wheel Strategy Channel within the GammaEdge Discord.

- Paper trade the approach: Before risking capital, run through the complete cycle with paper trading. Verify you can correctly qualify stocks through all three gates, calculate position sizing based on expectancy, and execute the management protocols without emotional override.

- Start with disciplined execution: When you’re ready for live capital, begin with single-contract positions. Focus on perfect execution of the systematic approach rather than immediate performance. Build your trade count, establish your expectancy baseline, and let the self-improving feedback loop work.

Free Resources to Accelerate Your Implementation:

This way of thinking about options market structure may be entirely new for you. That’s precisely why we created the GammaEdge FastPass—our flagship educational course designed to accelerate your learning curve significantly.

As with all our education, it’s completely free and provides you with everything a paid member of our community receives. That includes our complete methodologies, proven strategies, systematic frameworks, and institutional-level tools. We hold nothing back.

The Choice: Hope or Structure

Traditional wheel strategies ask you to sell premium and hope market conditions stay favorable. Hope the stock you selected has genuine quality. Hope assignments occur on names that recover efficiently. Hope your timing doesn’t put you on the wrong side of a deteriorating structure.

The GammaEdge Wheel Strategy eliminates hoping.

You see where institutional money is positioned. You know when macro conditions support new entries. You only accept assignments on stocks with proven momentum quality. You manage every scenario—profitable exits, assignments, basis reduction—through systematic protocols designed for consistency.

The edge isn’t complicated. It provides systematic visibility into the forces that drive outcomes.

Stop running the wheel blind. Start executing with the structural analysis that separates consistent profitability from expensive lessons.

Your capital deserves better than hope-based strategies. Give it the systematic edge it’s been missing.